In light of the city of San Diego’s stringent new mandates concerning short-term vacation rentals, property owners looking to leverage hosting platforms like Airbnb must navigate a complex legal landscape. San Diego’s Airbnb laws have significantly narrowed the scope of permissible rental options, excluding various nontraditional dwellings from the short-term rental market.

Understanding the intricacies of these regulations is critical for any property owner to ensure compliance and to successfully acquire a short-term rental license. This article aims to simplify the recent changes, assisting owners in making informed decisions about their rental strategies in San Diego’s dynamic real estate environment.

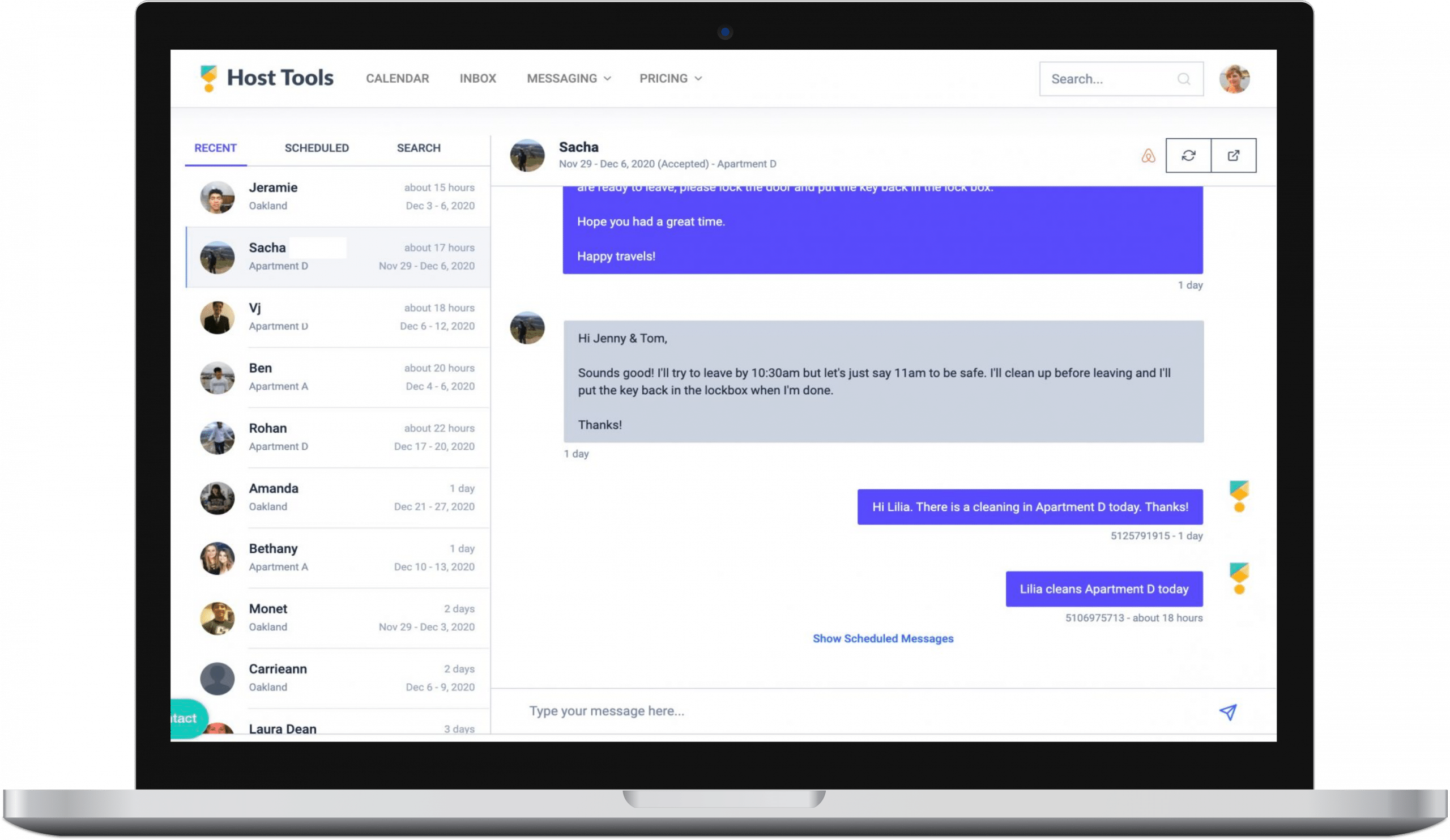

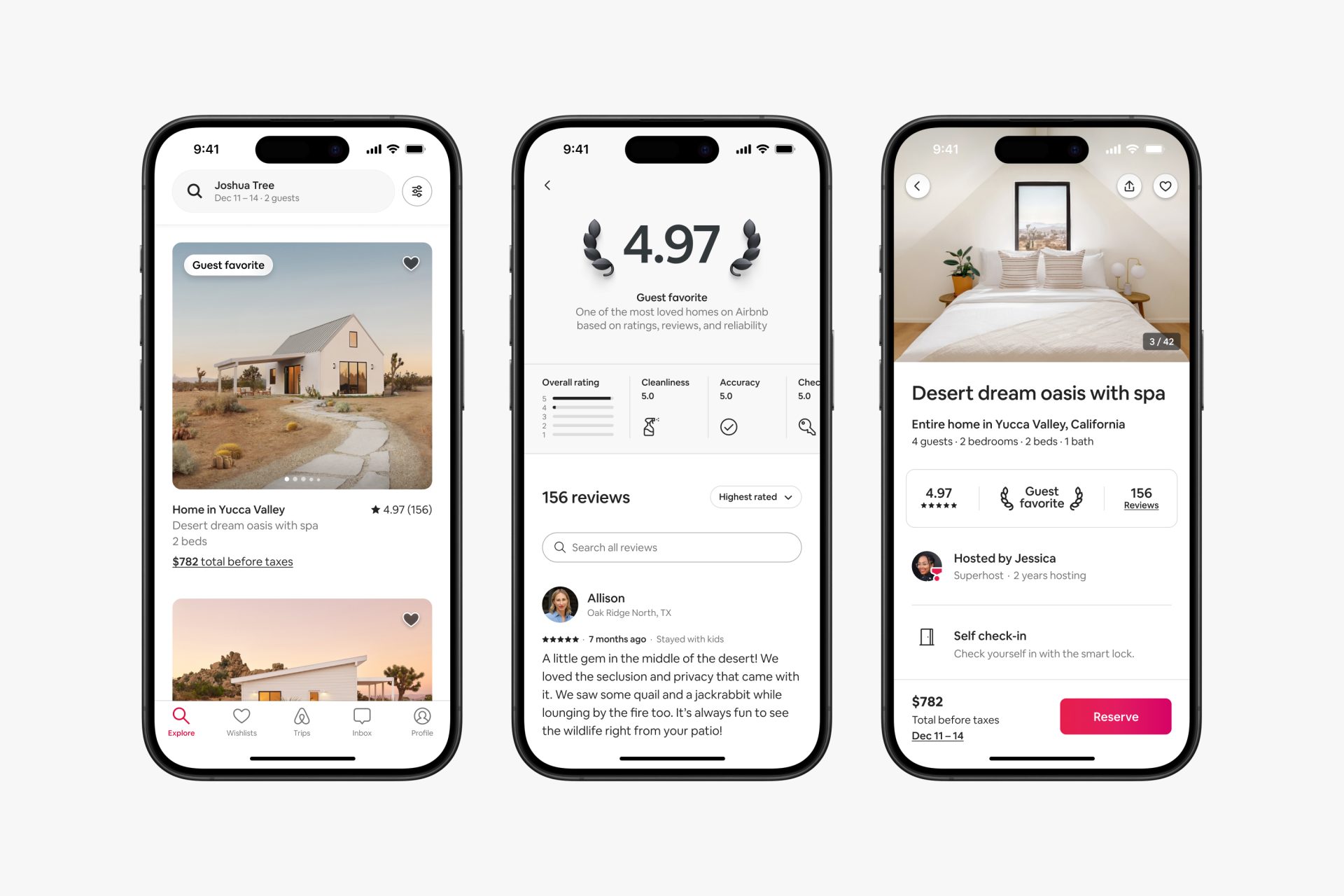

Host Tools provides an automated, unified calendar for short-term rental hosts, allowing you to seamlessly list on all major channels. Start your free trial today!

How to Get Your Rental Unit Business Tax Account Number in San Diego

To comply with San Diego’s regulations, every Airbnb host must obtain a Rental Unit Business Tax Account Number. This requirement applies whether you’re renting out a complete property or just a room. The process involves submitting an application to the Office of the City Treasurer, which can typically be completed online, in person, or via mail.

Once the application is reviewed and if it meets the City’s compliance standards, the host will be issued a Rental Unit Business Tax Account Number. This number must be clearly displayed in all advertisements and communications regarding the rental property.

It serves as a reference that links the short-term rental to the city’s tax records, ensuring transparency and proper tax collection. Property owners should renew their business tax certificate annually to avoid penalties and maintain the validity of their short-term rental license within the city of San Diego.

What is the Transient Occupancy Tax Certificate in San Diego?

After securing a Rental Unit Business Tax Account Number, the next step for every short-term rental owner in San Diego is to obtain a Transient Occupancy Tax Certificate. The Transient Occupancy Tax (TOT) Certificate is a legal document that signifies the owner’s responsibility to collect and remit taxes from transients who stay at their short-term rental for less than a month. This applies to all forms of short-term accommodations, from hotels and motels to short-term rental properties and RV parks.

To obtain this certificate, a property owner must apply through the Office of the City Treasurer’s website. The process entails providing detailed information about the rental property and ensuring that all prerequisite business licenses are in order.

Once the application is submitted and approved, the owner will be granted a TOT Certificate, which should be prominently displayed at the rental property, and mentioned in all advertising materials. Owner compliance is strictly monitored to maintain the integrity of the tourism infrastructure and fiscal resources in the city of San Diego.

See Related:What Is the Transient Occupancy Tax? A Complete Guide to California Rentals

Obtaining a Short-Term Rental License in San Diego

With the passing of San Diego’s new short-term rental regulations, obtaining a short-term rental license is essential for any owner looking to rent out their property. The city categorizes short-term vacation rentals into four tiers, each with specific requirements tailored to different rental scenarios.

To get a short-term rental license in San Diego, an owner must ensure that their property meets the zoning, safety, and operational standards set by the city. The application process begins online at the City of San Diego’s Short-Term Rental portal.

Here, the owner will complete an application form, submit relevant documentation, and, depending on the tier of operation, possibly consult with neighboring property owners. Key documents generally include:

- Proof of residency

- A detailed property floor plan

- A site diagram showing smoke detectors and fire extinguishers.

After the submission and review process, the city will issue a short-term rental license, granting the owner the official capacity to operate within the guidelines. Owners must remember that under the city’s 2022 regulations, an individual can only hold one short-term rental license.

However, a workaround is to have a spouse or business partner apply for the license of the second property to maintain multiple short-term rentals. As mentioned above, San Deigo offers four tiers of short-term rental licenses. They include:

Tier 1

There is no cap on how many people can be issued a Tier 1 short-term rental license. Plus, hosts aren’t required to live at the property they are renting out. The downside is you can only rent out the property a maximum of 19 nights per calendar year.

Tier 2

Again, there is no limit to how many hosts can obtain a Tier 2 license. Additionally, hosts are allowed to rent out the property as many days per year as they can. The catch is that hosts must reside onsite for their rental.

Tier 3

Unfortunately, there are a limited number of licenses available. But, if you do snag one, you can rent as many nights as possible, and you don’t need to live at the rental. However, no Tier 3: Unfortunately, there are a limited number of licenses available. It can be a bit tricky to obtain a Tier 3 license as you must enter a lottery.

Tier 4 – Mission Beach

Tier 4 is essentially the same as Tier 3, except that it’s exclusive to the Mission Beach Bay area. The supply of licenses is higher than Tier 3 but is capped at 30% of the total housing units.

Rules for Accessory Dwelling Units in San Diego

The landscape is fraught with regulatory nuances for owners eyeing Accessory Dwelling Units (ADUs) as potential short-term rentals in San Diego. As of the city’s 2022 legislation, the only eligible accessory dwelling units must have been constructed before September 2017 to stand a solid chance of securing a short-term rental license. Even then, San Diego’s requirement is stringent; owners must prove their ADU was both built with the correct permits and apply for a license, which is subject to approval through the city’s application process.

This underscores the importance of compliance with local laws when considering the profitability and legality of ADUs as short-term rentals. Owners contemplating the construction of a new ADU should be aware that current rulings do not favor their use as short-term rentals. Therefore, strategizing toward long-term tenancy may be a more viable avenue.

Nontraditional and Temporary Structures: Off-Limits for Short-Term Rentals in San Diego

In San Diego’s pursuit to regulate the vacation rental market, a new mandate has explicitly ruled out the inclusion of nontraditional housing units and temporary structures from being listed on platforms like Airbnb. Nonconforming are considered:

- RVs and campers

- Housing deemed affordable under specific programs

- Student-oriented housing solutions

- ADUs erected post-September 2017

- Treehouses

- Tents

- Converted garages lacking proper permits

- Sheds

- Commercial units repurposed as living spaces

- Boats

Owners of such units who were eyeing the lucrative potential of vacation rental income must now pivot, as these structures no longer qualify for a short-term rental license. It’s a wry note for residents that even basements—often uncommon in San Diego—would hypothetically be off-limits if they existed.

Final Thoughts on San Diego Airbnb Laws

As San Diego tightens regulations around how to operate short-term rentals, owners must navigate the new legal landscape with diligence and creativity. Obtaining a short-term rental license now comes with stricter criteria, particularly excluding a range of nontraditional living spaces.

This decisive move by city regulators aims to preserve housing affordability and neighborhood integrity. For homeowners, this may mean exploring alternative paths such as long-term leasing or occupying secondary units themselves while renting out their primary residence.

It’s vital for potential hosts to understand these nuances to ensure that their rental practices align with the ever evolving policies of San Diego. Those who do will be best positioned to benefit from the city’s vibrant tourism economy, remaining both legal and profitable in their rental endeavors.

Host Tools provides an automated, unified calendar for short-term rental hosts, allowing you to seamlessly list on all major channels. Start your free trial today!