Being a short-term rental host, whether just starting out or managing a small empire, offers a whirlwind of opportunities and challenges. Managing your finances often stands as one of the most intimidating hurdles. This is where learning about property management accounting comes in.

Accounting isn’t just about keeping the taxman at bay; it’s about understanding the ebbs and flows of income, planning for growth, and maximizing your profits. In this blog post, we’ll cover every facet of accounting practices tailored to short-term rental hosts, ensuring you’re equipped to build a strong financial foundation for your short-term rental business.

Host Tools provides an automated, unified calendar for short-term rental hosts, allowing you to seamlessly list on all major channels. Start your free trial today!

Best Practices for Your Short-term Rental & Property Management Company

Remember that even the most successful hosts had to start somewhere. Without further ado, here are the top accounting practices that can transform the way you manage your property’s finances.

1. Tracking income and expenses for multiple properties

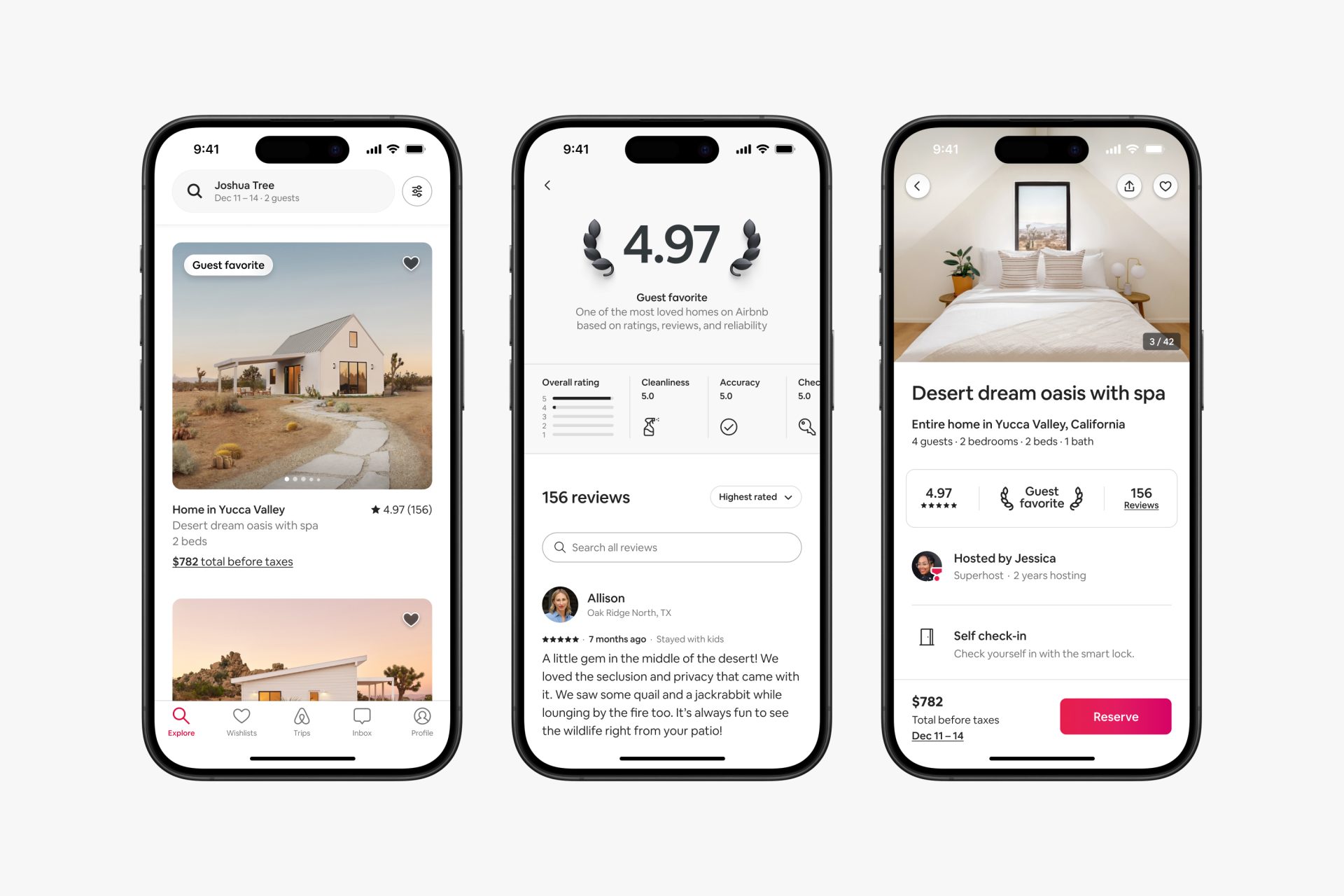

As you know, managing several properties is not uncommon. With platforms like Airbnb, Booking.com, and VRBO, hosts have multiple streams of income — but with it comes the challenge of monitoring expenses and revenues in a consolidated and organized manner.

Hosts should use accounting software to keep detailed income and expense records for each property, categorizing everything from property maintenance to any upsell experiences. This not only simplifies tax reporting but also provides a clear picture of each property’s financial health.

Leveraging accounting software that allows for multiple property tracking can be a game-changer for vacation rental businesses of any size. Features like custom reporting and integration with bank accounts and payment gateways will save you time and provide actionable insights.

2. Understanding tax regulations specific to short-term rentals

Navigating tax regulations as a short-term rental host is not a simple undertaking. Unlike long-term rentals, income from short-term rentals often falls within more complex tax brackets due to variability and potential for personal use of the property.

Hosts must familiarize themselves with income tax, sales tax (if applicable), and any local occupancy tax laws that pertain to their properties. To ensure compliance, consult with a tax professional who has experience with short-term rentals.

Tax management software may also be helpful. Many software options help track deductible expenses, calculate taxes, and even file returns electronically, simplifying what can be a daunting process.

3. Managing cash flow and setting aside funds for maintenance and upgrades

Cash flow is the lifeblood of any business, and short-term rentals can be particularly unpredictable due to seasonal variations and unexpected expenses. Hosts need to walk a line between reinvesting income for property improvements and setting aside funds to cover maintenance, repairs, and additional taxes.

Developing a financial calendar that includes regular maintenance checks, scheduled property upgrades, and quarterly tax payment dates can help you plan and pre-empt major expenses. Additionally, creating a cash reserve dedicated to these costs can provide peace of mind and stability in your finances.

An effective strategy is to allocate a certain percentage of each booking towards these funds, ensuring that you’re not only maintaining your property to a high standard but also preparing for those inevitable rainy days.

4. Implement clear policies for refunds, security deposits, and payments

Clearly outlined policies for refunds, security deposits, and payment scheduling can reduce misunderstandings and ensure you get paid on time. Your policies should be documented and easily accessible to guests, well-communicated during the booking process, and consistently enforced.

This not only improves financial security but also builds trust with guests, which can lead to positive reviews and repeat business. Regularly reviewing and updating these policies is a good idea in order to stay current with market trends and maintain your competitive edge in the industry.

5. Keeping detailed and accurate records

As with anything, it’s important to pay attention to your finances and bank accounts. It means not only logging transactions as they occur but also reconciling accounts and ensuring accuracy in your reports.

Inaccurate records can have far-reaching implications beyond tax time and may lead to mismanagement of resources. Automated record-keeping can minimize human error, and regular audits of your financial data can mitigate any potential discrepancies. These records are your business’s story; they provide historical context, allow for benchmarking against industry standards, and serve as evidence in the event of an audit or dispute.

6. Treating your short-term rental as a business, not a hobby

One common pitfall among new short-term rental hosts is neglecting to treat their venture as a business. This mindset shift is needed for successful accounting practices and impacts everything from deductible expenses to professional financial management.

Hosts should form a separate legal entity, like an LLC, for their short-term rental to protect personal assets and clearly distinguish between personal and business finances. This will enable a more straightforward tax process and open the door for business financial services and loans. It also signals a commitment to professionalism that can reflect in marketing, guest experiences, and, ultimately, the bottom line.

7. Conducting regular financial check-ins

Develop the habit of conducting regular financial check-ins to review the health of your short-term rental business. These check-ins should involve comparing actuals to budgets or forecasts, analyzing income and expenses, and identifying any financial trends or anomalies.

Such activities keep you proactive and can help you make informed decisions, such as adjusting nightly rates based on market analysis or scaling expenses in response to a decline in bookings. Regular financial reviews also make it less likely that financial issues will catch you off guard and can flag potential problems early, allowing for timely intervention.

8. Separating personal and business finances

This is one cardinal rule of financial management that’s especially critical for short-term rental hosts. Mixing personal and business finances can lead to confusion, make tax time more challenging, and hinder the ability to track business performance accurately.

Opening a business bank account and obtaining a business credit card for your short-term rental simplifies bookkeeping, ensures that tax deductions are properly documented, and contributes to the integrity of your financial data. Furthermore, maintaining separate finances is a fundamental practice that demonstrates a serious commitment to your business and can have legal and tax advantages.

9. Work with an accountant

While many short-term rental hosts start off managing their own finances, as the business grows, working with an accountant becomes a wise decision. Accountants experienced in the hospitality sector and familiar with short-term rental tax implications can provide invaluable advice and analysis.

Whether outsourced or in-house, professional accountants can handle complex financial tasks, provide strategic guidance, and ensure that your business remains compliant with financial regulations. For small to mid-sized rental operations, hiring part-time or consulting accountants is a cost-effective way to benefit from professional expertise without the burden of a full-time salary.

Tools and Software for Simplifying Accounting

In today’s digital age, many platforms offer comprehensive solutions that can drastically simplify accounting processes. These include everything from tracking expenses and income to generating detailed financial reports. Below, we’ll introduce some of the most effective accounting software and tools to consider for your vacation rental business:

QuickBooks:

- Ease of Use: QuickBooks is popular for its user-friendly interface, which is suitable for both newbies and pros in accounting.

- Integration: Integrates with numerous business applications and banking systems, making financial management more straightforward.

- Features: It offers a broad range of features, including tracking expenses, managing invoices, payroll processing, and generating financial reports.

- Scalability: Adaptable for both small startups and expanding businesses, providing various editions tailored to specific business needs.

FreshBooks:

- Designed for small and medium size businsses: FreshBooks is ideal for small businesses and self-employed professionals, with a strong emphasis on simplicity and invoicing.

- Customization: Allows for easy customization of invoices, enabling businesses to incorporate their branding.

- Time Tracking: Includes time tracking capabilities, ensuring accurate billing for hourly work.

- Client Management: Provides tools for managing client information and interactions efficiently.

Xero:

- Cloud-Based: Xero is a fully cloud-based accounting solution, offering the flexibility to access financial information from anywhere.

- Real-Time Data: Provides real-time financial data, allowing businesses to make informed decisions swiftly.

- Comprehensive Dashboard: Features a comprehensive dashboard with an overview of your business’s financial health at a glance.

- Third-Party Integrations: Supports a wide range of third-party apps, enhancing its functionality and customization options.

Tips for Choosing the Right Tools Based on Property Size and Needs

Choosing the right property management accounting software for your business can feel like navigating a maze. Here are some friendly pointers to guide you through:

- Understand Your Needs: Before jumping into any decisions, take a moment to assess what you really need from a property management accounting software.

- Scalability is Key: Consider not just where your business stands today but where it’s heading. Look for property management accounting software that can grow with you, offering features that cater to both your current situation and future expansion.

- Ease of Use Matters: You want to spend time growing your business, not wrestling with complicated software. Prioritize tools that are known for their user-friendliness and straightforward setup.

- The Importance of Accessibility: In our always-on, mobile world, having access to your financial data from anywhere, at any time, can be a game-changer. Opt for cloud-based solutions that offer this flexibility.

- Integration is Your Friend: The more your property management accounting software plays nicely with other apps and services you use, the smoother your operations will run. Look for platforms that offer strong third-party integration capabilities.

Remember, the best tool is the one that fits your unique business needs and helps alleviate the stress of financial management so you can focus on what you do best.

Final Thoughts on Accounting for Property Management Teams

Having strong property management accounting practices is the bedrock of a successful short-term rental business. By implementing the best practices outlined in this guide and leveraging the right tools and software, hosts can ensure financial stability, growth, and longevity in this burgeoning industry.

With a proactive approach to accounting, short-term rental hosts can focus on what they do best: providing memorable experiences for their guests. As the short-term rental landscape continues to evolve, staying informed and adaptable is key. Hosts who prioritize sound property management accounting will thrive in the current market and set the stage for continued success in the years to come.

Host Tools provides an automated, unified calendar for short-term rental hosts, allowing you to seamlessly list on all major channels. Start your free trial today!