Welcome to the world of Airbnb hosting in the Sunshine State! Before you start welcoming guests through your door, it’s essential to understand the local laws governing short-term rentals in Florida. Don’t worry; it’s not as daunting as it might sound. Navigating Airbnb laws in Florida is just part of being a responsible host.

In this guide, we’ll demystify the regulations that you need to know so you can focus on providing a fantastic Florida experience for your guests. So grab a cup of coffee, and let’s dive in!

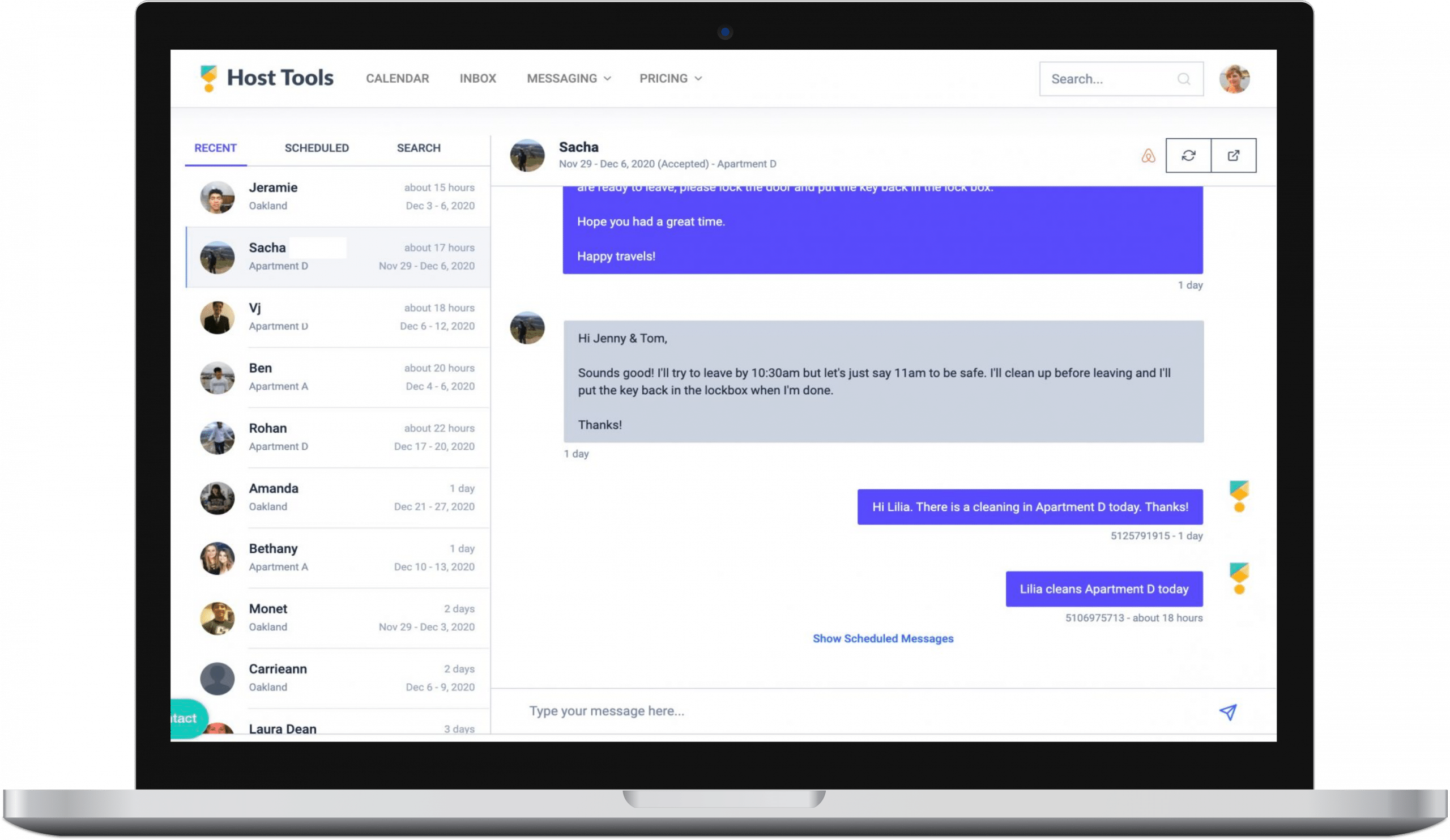

Host Tools provides an automated, unified calendar for short-term rental hosts, allowing you to seamlessly list on all major channels. Start your free trial today!

The Essentials of Airbnb Laws in Florida

As we delve deeper into the specifics of Airbnb laws in Florida, it’s critical to note that these regulations are not uniform and vary greatly at the state and local levels.

Statewide Regulations

In Florida, Airbnb hosts are guided by specific statewide regulations. These include obligatory licensing requirements, which mandate short-term rental hosts to acquire a license from the Florida Department of Business and Professional Regulation.

Also, hosts are subject to certain tax obligations, including but not limited to tourist development tax, sales tax, and local option transient rental tax.

Local County/City Regulations

On a more local scale, each county or city in Florida has the authority to enforce its own set of regulations. This often involves zoning ordinances designating specific zones where short-term rentals are permitted.

Furthermore, local jurisdictions are tasked with ensuring that Airbnb properties comply with safety and health regulations, such as fire safety standards, sanitation protocols, and building codes.

In short:

-

State sales tax: The state takes 6% of the rent charged to short-term rental guests

-

Local tourist tax: This varies by local government but can be anywhere between 1-5% (charged by you, the host)

-

Discretionary sales tax: Some counties require a 0.5-1.0% tax. Check with your local government.

-

Commercial rental tax: This only applies in select Florida counties.

Notable Court Cases and Legal Precedents

Stepping away from direct legislation, examining crucial court cases and legal precedents that have shaped the current Airbnb laws in Florida is pertinent. These cases often involve disputes between hosts and local authorities, which have profound implications on how laws are interpreted and enforced.

Key Court Cases Impacting Airbnb Laws in Florida

Court cases serve as valuable sources of insight, often revealing the complexities of the Airbnb regulatory landscape in Florida. Some of these noteworthy disputes include the case of “City of Miami v. Airbnb,” where Airbnb and its hosts challenged the city’s ordinance restricting short-term rentals.

Implications and Takeaways for Airbnb Hosts

These court cases not only shape the legal framework but also carry significant implications for short-term rental hosts. They underscore the importance of being vigilant about local ordinances in addition to statewide regulations, as non-compliance can result in legal battles.

For hosts, this suggests a greater need to familiarize themselves with the specific laws applicable to their area and make necessary adjustments to their operations to avoid potential legal repercussions.

How to Stay Compliant with Airbnb Laws in Florida

Now that we’ve explored the complexities of Airbnb laws in Florida and the importance of staying compliant, it’s time to discuss practical tips and resources for Airbnb hosts.

The following section aims to help hosts confidently navigate the regulatory waters and ensure they operate within the legal frameworks in place.

Tips for Airbnb Hosts

-

Be Proactive: It’s essential to stay updated about any changes in the laws at both state and local levels. Regularly check official websites for updates and consider joining local host communities for shared insights and experiences.

-

Seek Legal Advice: Consult a professional specializing in short-term rental laws to help you understand your legal obligations. This can help you avoid costly mistakes and ensure your operations comply with all relevant laws.

-

Maintain Good Records: Keep thorough records of all your transactions, including receipts for taxes paid, to prove your compliance if necessary.

Resources for Further Guidance

For further guidance, hosts can refer to the following resources:

-

Florida Department of Business and Professional Regulation: The official website provides up-to-date information about licensing requirements and other regulations.

-

Airbnb’s Responsible Hosting Page: This page offers a comprehensive guide for hosts about the platform’s policies, community standards, and more.

-

Local Airbnb Host Groups: Joining these groups can provide a platform for hosts to share their experiences, insights, and tips about managing short-term rentals in compliance with local laws.

-

Professional Legal Services: Legal professionals specializing in short-term rental laws can provide personalized guidance tailored to your specific situation.

Notable Court Cases and Legal Precedents

Stepping away from direct legislation, examining crucial court cases and legal precedents that have shaped the current Airbnb laws in Florida is pertinent. These cases often involve disputes between hosts and local authorities, which have profound implications on how laws are interpreted and enforced.

Key Court Cases Impacting Airbnb Laws in Florida

Court cases serve as valuable sources of insight, often revealing the complexities of the Airbnb regulatory landscape in Florida. Some of these noteworthy disputes include the case of “City of Miami v. Airbnb,” where Airbnb and its hosts challenged the city’s ordinance restricting short-term rentals.

Implications and Takeaways for Airbnb Hosts

These court cases not only shape the legal framework but also carry significant implications for short-term rental hosts. They underscore the importance of being vigilant about local ordinances in addition to statewide regulations, as non-compliance can result in legal battles.

For hosts, this suggests a greater need to familiarize themselves with the specific laws applicable to their area and make necessary adjustments to their operations to avoid potential legal repercussions.

How to Stay Compliant with Airbnb Laws in Florida

Now that we’ve explored the complexities of Airbnb laws in Florida and the importance of staying compliant, it’s time to discuss practical tips and resources for Airbnb hosts.

The following section aims to help hosts confidently navigate the regulatory waters and ensure they operate within the legal frameworks in place.

Tips for Airbnb Hosts

-

Be Proactive: It’s essential to stay updated about any changes in the laws at both state and local levels. Regularly check official websites for updates and consider joining local host communities for shared insights and experiences.

-

Seek Legal Advice: Consult a professional specializing in short-term rental laws to help you understand your legal obligations. This can help you avoid costly mistakes and ensure your operations comply with all relevant laws.

-

Maintain Good Records: Keep thorough records of all your transactions, including receipts for taxes paid, to prove your compliance if necessary.

Resources for Further Guidance

For further guidance, hosts can refer to the following resources:

-

Florida Department of Business and Professional Regulation: The official website provides up-to-date information about licensing requirements and other regulations.

-

Airbnb’s Responsible Hosting Page: This page offers a comprehensive guide for hosts about the platform’s policies, community standards, and more.

-

Local Airbnb Host Groups: Joining these groups can provide a platform for hosts to share their experiences, insights, and tips about managing short-term rentals in compliance with local laws.

-

Professional Legal Services: Legal professionals specializing in short-term rental laws can provide personalized guidance tailored to your specific situation.

By following these tips and leveraging these resources, short-term rental hosts can ensure they stay within the bounds of Florida’s laws while providing top-notch service to their guests.

By following these tips and leveraging these resources, short-term rental hosts can ensure they stay within the bounds of Florida’s laws while providing top-notch service to their guests.

Closing Thoughts

Understanding and complying with short-term rental laws in Florida is not merely a legal obligation but a crucial component in building trust with guests and the broader community. Failure to comply can invite hefty fines, legal battles, and even eviction, all of which can significantly derail your hosting journey. On the other hand, demonstrating compliance can bolster your credibility as a host, thereby enhancing guest satisfaction and loyalty.

The regulatory landscape is dynamic and subject to change. As such, hosts must stay updated with any modifications in the laws at both the state and local levels. Regularly reviewing official resources like the Florida Department of Business and Professional Regulation, Airbnb’s Responsible Hosting page, and local host groups can help keep you abreast of the evolving legal landscape. Remember, an informed host is ultimately a successful host.

Host Tools provides an automated, unified calendar for short-term rental hosts, allowing you to seamlessly list on all major channels. Start your free trial today!