Understanding your potential profits is critical for success in the short-term rental industry. Whether you’re a seasoned host or a budding property manager, estimating profit accurately can be the difference between thriving and merely surviving. This is where a rental calculation tool becomes invaluable.

In this blog post, we’ll explore how you can use this tool to make informed financial decisions and boost your rental income. You’ll learn how to calculate your return on investment (ROI) and the vital metrics ensuring your rental property is making the most of its potential.

Host Tools provides an automated, unified calendar for short-term rental hosts, allowing you to seamlessly list on all major channels. Start your free trial today!

Understanding the Rental Property Calculator

A rental property calculator is a digital tool designed to help rental property owners and managers assess the profitability of their rental properties. It combines various financial metrics and data points to clearly show potential earnings and expenses. You can obtain an accurate estimate of your property’s profitability by inputting figures such as rental income, costs, and other critical factors.

These online tools simplify the complex calculations associated with property management. No more sifting through spreadsheets or fumbling with formulas. With a rental property calculator, you can quickly determine if your property is meeting your financial goals. It’s designed specifically for those in the short-term rental market, making it highly relevant for Airbnb hosts and property managers.

Using a rental property calculator allows you to make informed decisions about pricing, property improvements, and marketing strategies. With an accurate profit forecast, you can set competitive rates that attract guests while ensuring a healthy profit margin. This proactive approach helps you stay ahead in the competitive rental market.

Calculating Your ROI

Return on Investment (ROI) is a key indicator of your property’s financial performance. It measures how much profit you’re earning relative to your investment. To calculate ROI accurately, you’ll need to consider various factors, including costs, expenses, revenue, and more.

Costs and expenses

Understanding the costs associated with your rental property is needed to calculate ROI. These can be divided into two main categories—upfront costs and monthly expenses. Upfront costs include:

- Purchase price

- Closing costs

- Initial repairs or renovations

These are one-time expenses but can significantly impact your overall investment. Monthly costs, on the other hand, include:

- Utilities

- Maintenance

- Property management fees

- Cleaning costs

- Insurance

- Mortgage payments

These recurring expenses, including property taxes, must be factored into your ROI calculations to get a true sense of your property’s profitability. Ignoring these costs can lead to overestimating your ROI and making poor financial decisions.

By accurately accounting for both upfront and monthly costs, you can identify areas where you might be overspending. This insight enables you to make necessary adjustments, such as negotiating better service rates or implementing cost-saving measures.

Revenue

Revenue is the income generated from your rental property. For short-term rentals like Airbnb, this includes nightly rates, cleaning fees, long-term stay monthly rent, and any additional charges for amenities, upsells, or services.

To estimate revenue accurately, consider factors such as occupancy rates, peak seasons, and local market demand. A rental property calculator can help you analyze historical data and predict future revenue trends. This allows you to adjust your pricing strategy to maximize income while remaining competitive in the market.

It’s also important to regularly review and update your revenue estimates. Market conditions and guest preferences can change, impacting your property’s earning potential. Staying informed and flexible ensures you maintain a steady stream of income and a healthy ROI.

Key Metrics to Consider

When estimating profit on a short-term rental, several key metrics can provide valuable insights into your property’s financial performance. These metrics help you understand the factors driving profitability and identify areas for improvement.

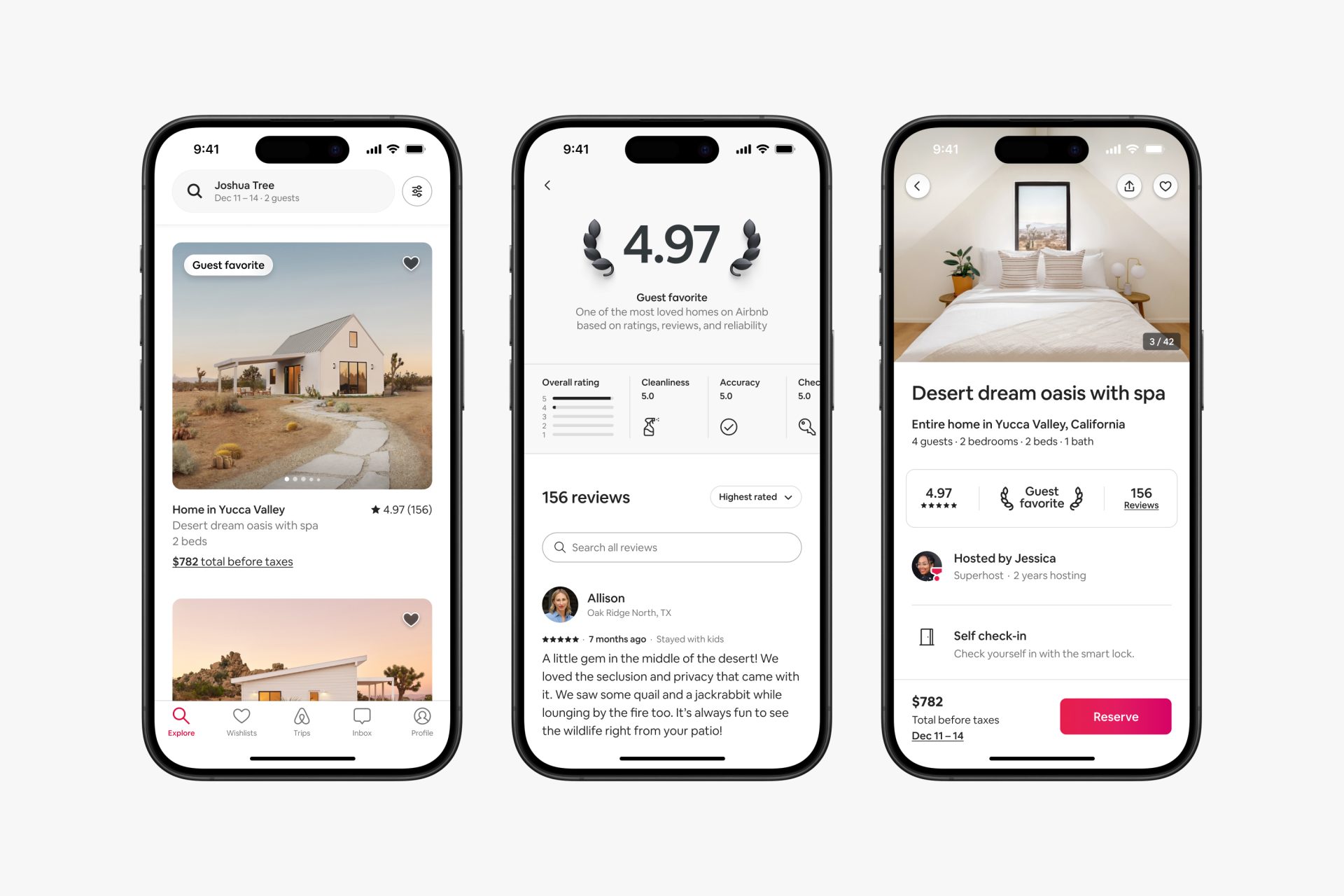

One essential metric is the occupancy rate, which measures the percentage of time your property is rented out. A high occupancy rate indicates strong demand and maximized revenue potential. Analyzing occupancy trends helps you adjust your pricing and marketing strategies to attract more guests.

Another important metric is the average daily rate (ADR), which represents the average rental property income generated per occupied night. By tracking ADR, you can evaluate the effectiveness of your pricing strategy and make informed adjustments to maximize revenue. Additionally, monitoring guest reviews and feedback can provide insights into areas where you can enhance the guest experience and increase ADR.

Understanding Cap Rates

Capitalization rate, or cap rate, is a metric used to evaluate the profitability of a rental property investment. It is calculated by dividing the property’s net operating income (NOI) by its current market value. Understanding cap rates is crucial for assessing the potential return on investment and making informed decisions about property investments.

A higher cap rate generally indicates a more profitable investment, as it suggests a higher return relative to the property’s market value. However, it also means the investment may be more risky. Of course, other factors, such as market trends and property conditions, must also be considered when evaluating cap rates. A low cap rate may be better if the property is in a prime location with strong appreciation potential, as there is less risk for the buyer.

Property managers and Airbnb hosts can gain valuable insights into their property’s financial performance by regularly analyzing cap rates. This information allows them to make informed decisions about pricing, marketing, and property improvements to maximize profitability.

Best Online Rental Calculation Tools

Utilizing reliable online rental calculators can simplify assessing your property’s performance and help make informed financial decisions. Here’s a list of some of the best online rental calculation tools available:

- AirDNA

- Roofstock

- Zillow Rental Manager

- Rentometer

- BiggerPockets Calculator

- Mashvisor

By leveraging these online tools, property managers and hosts can gain deeper insights into their rental properties and enhance their overall investment strategy.

Final Thoughts on Rental Calculation

Estimating profit on a short-term rental is an essential aspect of successful property management. By utilizing a rental calculation tool and considering key metrics such as ROI, costs, revenue, and cap rates, Airbnb hosts and property managers can make informed financial decisions on rental property investing. This proactive approach ensures long-term profitability and enhances the guest experience.

For those looking to maximize their short-term rental profits, incorporating a rental property calculator into their business strategy is a smart move. These tools provide valuable insights and simplify complex calculations, allowing property managers and Airbnb hosts to focus on delivering exceptional guest experiences within their rental property investments.

Host Tools provides an automated, unified calendar for short-term rental hosts, allowing you to seamlessly list on all major channels. Start your free trial today!