If you’re one of the millions of people who rented out their property as a short-term rental last year, congratulations! But along with the extra income comes the responsibility of filing your taxes. The good news? Several tax deductions can help you reduce your taxable income and save money on your tax bill.

In this post, we’ll break down the tax deductions available to hosts and offer tips on how to easily document them for your taxes. By the end, you’ll have all the information you need to make the most of your rental income.

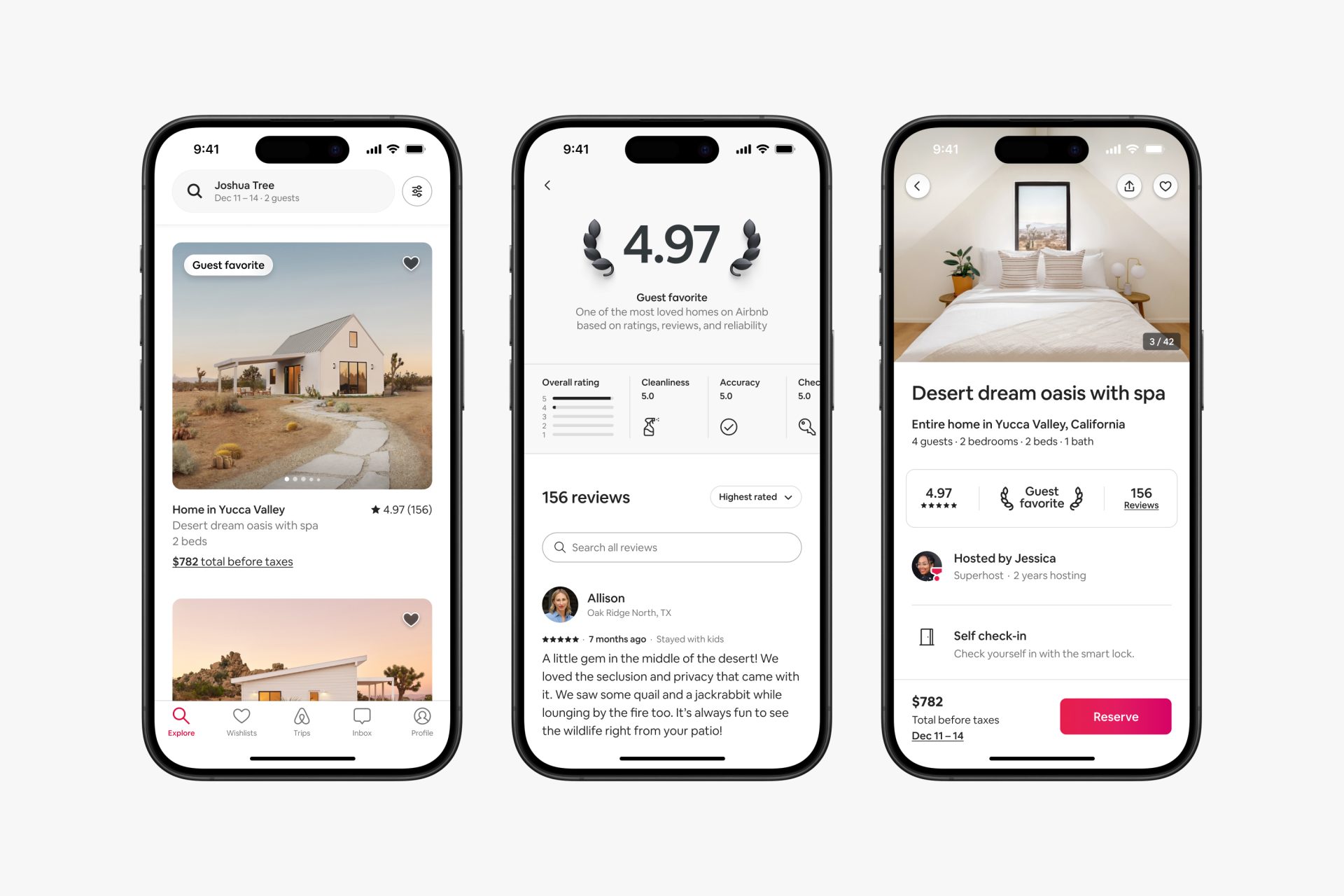

Host Tools provides an automated, unified calendar for short-term rental hosts, allowing you to seamlessly list on all major channels. Start your free trial today!

What are Tax Deductions for Airbnb?

Tax deductions are expenses you can subtract from your total income when calculating your taxable income. By claiming these deductions, you can lower the amount of Airbnb income taxes you owe.

For hosts, tax deductions can include a wide range of expenses related to renting out your property. These may include direct costs, such as cleaning services and repairs, and indirect costs, such as mortgage interest and property management fees.

It’s important to keep accurate records of your expenses throughout the year, as the IRS requires you to provide documentation for any deductions you claim. Additionally, you should only claim deductions directly related to your rental activity. Personal expenses, such as the cost of a family vacation at your rental property, are typically not deductible.

The Ultimate List of Tax Deductions for Airbnb Hosts

Let’s dive in!

1. Direct Costs

Direct costs are expenses that you incur specifically for your Airbnb business. These can include:

Advertising and Marketing

If you market your property on platforms like Airbnb, the fees you pay to these platforms are deductible. You can also deduct costs associated with any additional advertising, such as social media or local newspaper ads.

Cleaning and Maintenance

Any fees you pay for cleaning your rental properties between guests or for maintenance work are deductible.

Supplies

This includes items you provide for guests, such as soap, shampoo, towels, and linens.

2. Property Expenses

Expenses related to the rental property itself can also be deducted.

Mortgage Interest

You can deduct the interest you pay if your property has a mortgage. This can be a substantial deduction for many hosts.

Property Taxes

Property taxes are also deductible; you can typically find this amount on your property tax bill.

Depreciation

Depreciation allows you to deduct a portion of the cost of your property over time rather than all at once.

3. Utility Costs

If your rental is a separate unit (such as a basement apartment), you can deduct the full utilities for that unit. If your rental is part of your home, you can only deduct the percentage that relates to the rental.

Electricity and Gas

The costs associated with heating and lighting your rental property can be deducted.

Water and Garbage Collection

Similar to electricity and gas, these costs are also deductible.

4. Insurance

The cost of any insurance policies related to your rental property can be deducted. This typically includes:

Homeowners Insurance

If you have a specific policy for your rental property, you can deduct the premium from your taxable income.

Liability Insurance

Liability insurance, which protects you in case of accidents or injuries on your property, is also deductible.

5. Travel Expenses

These costs can also be deducted if you need to travel to your rental property for business purposes. This includes:

Vehicle Expenses

You can deduct the costs of using your vehicle for business purposes, such as driving to the property for maintenance. If you use your vehicle for both personal and business purposes, you can deduct only the expenses related to the business use. This can be calculated using either the actual expense method or the standard mileage rate set by the IRS.

Travel Costs

If you must travel overnight to manage your rental property, you can deduct the costs of lodging and meals during the trip.

Attending Short-term Rental Conferences

If you’re furthering your education as a host or learning new tips and tricks about managing your rental property, the costs associated with attending conferences or workshops can be deducted.

Short-term Rental Courses

Educational expenses can also be deducted if they are directly related to your rental property business. This includes the cost of classes or workshops on topics such as property management, marketing, and tax preparation.

6. Professional Services

Fees paid to professionals who assist with your rental property can also be deducted. This includes:

Property Management Fees

If you hire a property management company or use vacation rental software to handle your rental, their fees are deductible.

Legal and Accounting Fees

You can also deduct the fees you pay for legal or tax advice from hiring an accountant to help with your rental property finances.

7. Home Office Expenses

If you have a dedicated space in your home where you manage your Airbnb business, you may be able to deduct associated expenses. These can include:

Office Supplies

Items such as paper, pens, and a computer can be deducted if they are used for your rental business.

A Portion of Home Expenses

If you have a designated area in your home that you use exclusively for managing your rental property, you may be able to deduct a portion of your home expenses, such as rent, mortgage interest, utilities, and home insurance. The amount you can deduct is typically based on the home office’s size relative to your home’s total size.

8. Other Expenses

Certain other expenses specific to your rental can also be deductible. These can include:

Guest Amenities

If you provide amenities to enhance your guests’ stay, such as a coffee maker or beach chairs, you can deduct these costs from your short-term rentals.

Memberships and Subscriptions

Costs associated with memberships or subscriptions that benefit your rental property, such as a Netflix account for guest use.

Repairs and Improvements

While you can typically deduct costs associated with repairs (like fixing a leaky faucet), improvements that increase the value of your property (like building a deck) must be depreciated over time rather than deducted at once.

What Are Not Tax Deductions for Airbnb Hosts

While many expenses related to your property can be deducted, some cannot. These include:

Personal Expenses

Costs incurred when using your rental for personal purposes are not tax-deductible. For example, if you take a family vacation at your rental property, you cannot deduct those expenses from your taxes as they are not technically business expenses.

Capital Improvements

While repairs can be deducted, capital improvements (like renovating your kitchen) must generally be depreciated over time rather than deducted all at once.

An Expense Related to Vacant Property

If your property is vacant for part of the year, you typically cannot deduct costs associated with that vacancy. However, a business expense related to renting the property (like advertising costs) may still be deductible.

Final Thoughts on Vacation Rental Business Deductions

Navigating tax deductions as an Airbnb host may seem challenging, but understanding the eligible deductions and maintaining proper records can lead you to major savings. Accurately documenting your expenses and seeking professional advice can simplify tax season and maximize your deductions.

Host Tools provides an automated, unified calendar for short-term rental hosts, allowing you to seamlessly list on all major channels. Start your free trial today!