There’s nothing quite like Southern hospitality and sweet tea. For short-term rental hosts in the Volunteer State, being well-versed in Tennessee’s short-term rental laws is crucial. Whether you’re a host or a property manager, understanding these regulations can help you avoid legal pitfalls and maximize your rental income.

Note: Regulations regarding vacation rentals are fast-moving and subject to change. It is important to stay informed and regularly check for updates from the city.

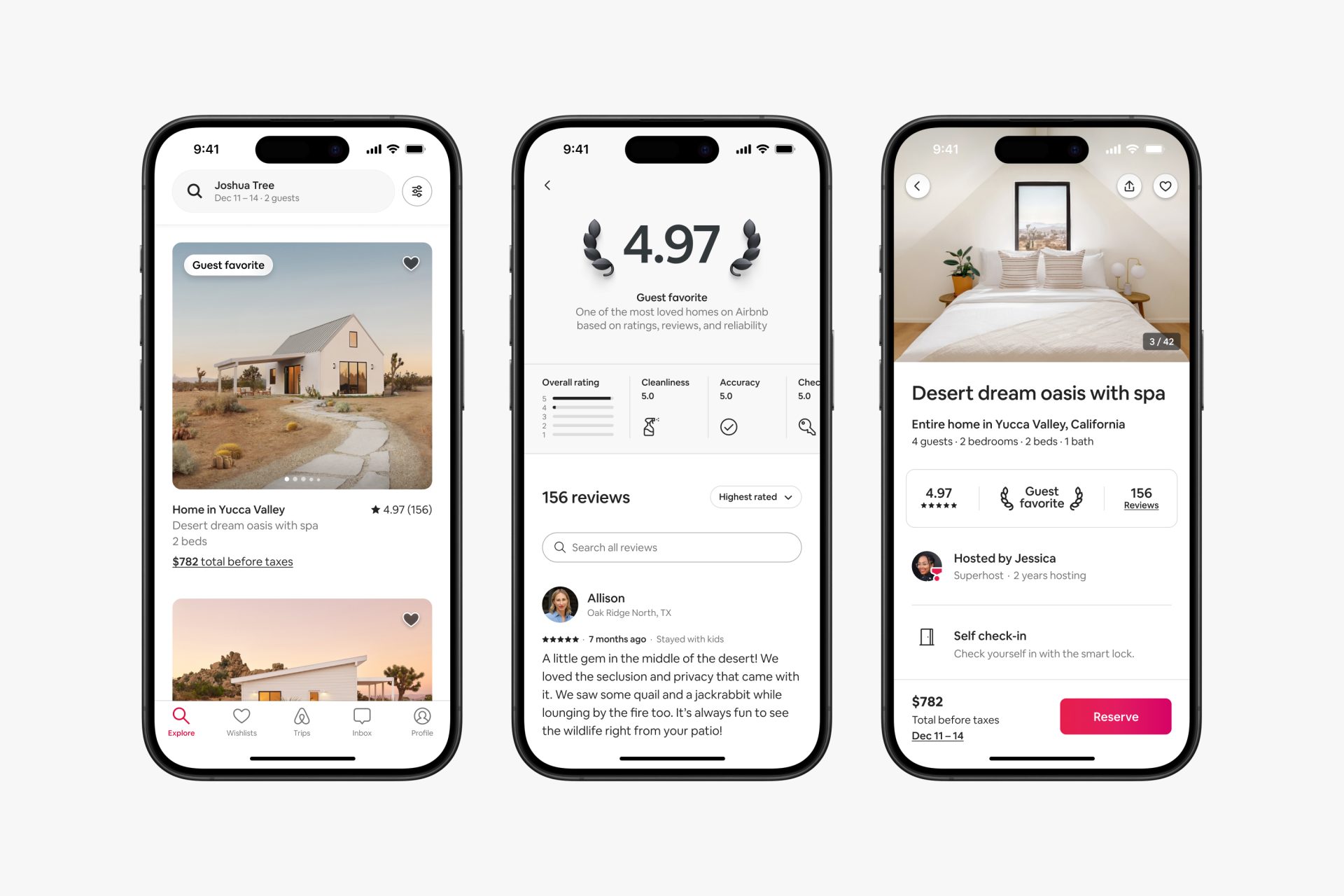

Host Tools provides an automated, unified calendar for short-term rental hosts, allowing you to seamlessly list on all major channels. Start your free trial today!

What is Considered a Short-term Rental in Tennessee?

A short-term rental in Tennessee is defined as a residential property that is rented out for less than 30 days at a time. This can include vacation rentals, Airbnb properties, and other types of short-term accommodations like cabins and condos.

Regulations Regarding Vacation Rentals in Tennessee

Let’s get into the nitty-gritty of Tennessee’s short-term rental laws. Below are some key regulations to keep in mind if you’re hosting vacation rental properties in the state:

Owner-occupied vs Non-owner-occupied short-term rentals

- Owner-Occupied: These are properties where the owner resides on the premises while renting out a portion of their home. Regulations may be more lenient for owner-occupied rentals, often making it easier to get a permit and fewer restrictions.

- Non-Owner Occupied: These are completely rented-out properties where the owner does not live on-site. Non-owner occupied properties typically face stricter short-term rental regulations, including more rigorous permit requirements and caps on rental durations.

How to Obtain a Short-Term Rental Permit

- Application Process: Submit an application to the local governing body. This process often includes proof of ownership, a site plan, and a sworn affidavit of compliance.

- Inspection: Properties may need to pass a safety and health inspection to ensure they meet local housing codes.

- Fees: Paying application and annual permit fees is generally required. Costs varying depending on the locality.

- Renewal: Permits typically need to be renewed annually, necessitating compliance with updated regulations and possible additional inspections. Be sure to budget for an annual renewal fee.

Obtain Business Licenses

To legally operate a short-term rental in Tennessee, obtaining a business license is a requisite step. Begin by visiting the Tennessee Department of Revenue website to determine the specific licensing requirements for your property.

As a business entity, you will need to complete an application form, which typically includes details about the property, the nature of the business, and property owner information. Additionally, you may be required to register for a Sales and Use Tax Certificate to collect and remit sales tax on rental income.

Be prepared to pay an application fee, which varies depending on the locality and the size of the short-term rental business. At the time of publishing, the average cost was $15 per listing. Once your application is reviewed and approved, you will receive your business license, enabling you to operate your short-term rental unit in compliance with state and local regulations.

Short-Term Rental Property Ordinance

Popular areas like Nashville and Davidson County already had regulations in place for short-term rentals, but a statewide ordinance was passed in 2018 to regulate vacation rentals across all of Tennessee. This ordinance outlines specific rules and requirements that must be met by short-term rental properties and their owners, including:

- Compliance: Hosts must adhere to local ordinances. These ordinances may cover aspects such as noise levels, parking requirements, and maximum occupancy.

- Taxes: Compliance with state and local tax collection requirements, including transient occupancy taxes, is mandatory.

- Insurance: Proof of liability insurance may be required to cover potential damages and injuries on the property.

- Penalties: Non-compliance can result in fines, permit revocation, and possible legal action.

Zoning Laws

- Zoning Districts: Ensure your property is located within a district zoned for short-term rentals. Some areas have designated zones where rentals are permitted, while others do not.

- Restrictions: Certain zoning laws may limit the number of short-term rental permits issued within specific neighborhoods, aiming to balance residential needs with tourism.

- Variance Requests: If a property is not in a permitted zoning district, owners may need to apply for a variance or special exception, which often involves a public hearing and neighborhood input.

- Changes in Zoning: Keep an eye on any upcoming changes to zoning laws that may affect the legality of short-term rentals in your area.

- ADU: Some areas have implemented Accessory Dwelling Units (ADUs) or Additional User Districts (AUDs), which allow for short-term vacation rentals in residential areas. Check with your local governments to see if this is an option for your property.

Short-term Rental Sales Tax in Tennessee

Short-term rental hosts in Tennessee are required to comply with a variety of tax regulations s to operate legally. One of the primary taxes is the Transient Occupancy Tax (TOT). It is often referred to as part of the local hotel occupancy taxes, which is assessed on guests staying in accommodations for a short-term duration. The rate of this tax can vary by county and municipality. This makes it essential for hosts to verify the specific requirements for their property’s location.

In addition to the transient occupancy tax, hosts must collect and remit Sales Tax on the rental income. The Tennessee sales tax rate is 7%, but an additional local sales tax may apply, which can range from 1.5% to 2.75%, depending on the county. These combined business taxes can significantly impact the final amount owed, so careful calculation and record-keeping are necessary.

Failure to comply with these applicable taxes can result in substantial penalties. These penalties may including fines and back taxes, making it important for hosts to stay informed and diligent in their tax contributions. Always consult with local tax authorities or a tax professional to ensure full compliance with all applicable tax laws. You can learn more about Tennessee taxes here.

Final Thoughts on Short-term Rental Properties in Tennessee

Owning and operating short-term rental units in Tennessee can be an excellent opportunity for hosts to generate a strong income. However, it’s essential to understand the Tennessee short-term rental laws surrounding this type of activity to avoid any potential legal or financial consequences.

When deciding whether short-term rental hosting is right for you, consider the various factors involved in managing a successful Airbnb property, such as location, local regulations, taxes, and property maintenance. It may also be beneficial to consult with a real estate professional, a local lawyer, experienced short-term rental operators, and a property management company for advice.

While there are challenges to navigate when managing a short-term rental property in Tennessee, with proper knowledge and preparation, this can be a profitable venture for hosts and property owners. As always, staying informed and proactive is key to success in the vacation rental industry.

Host Tools provides an automated, unified calendar for short-term rental hosts, allowing you to seamlessly list on all major channels. Start your free trial today!