Dreaming of becoming an Airbnb host in the Lone Star State? Texas is an enticing market for the budding Airbnb host with its diverse landscapes, vibrant cities, and rich cultural experiences. However, diving into the short-term rental world isn’t as simple as just listing your property on the platform and waiting for the bookings to roll in – especially in a state with a famously independent streak regarding regulation. This blog post serves as your blueprint for how to start an Airbnb in Texas, from understanding the legal framework to making your space stand out.

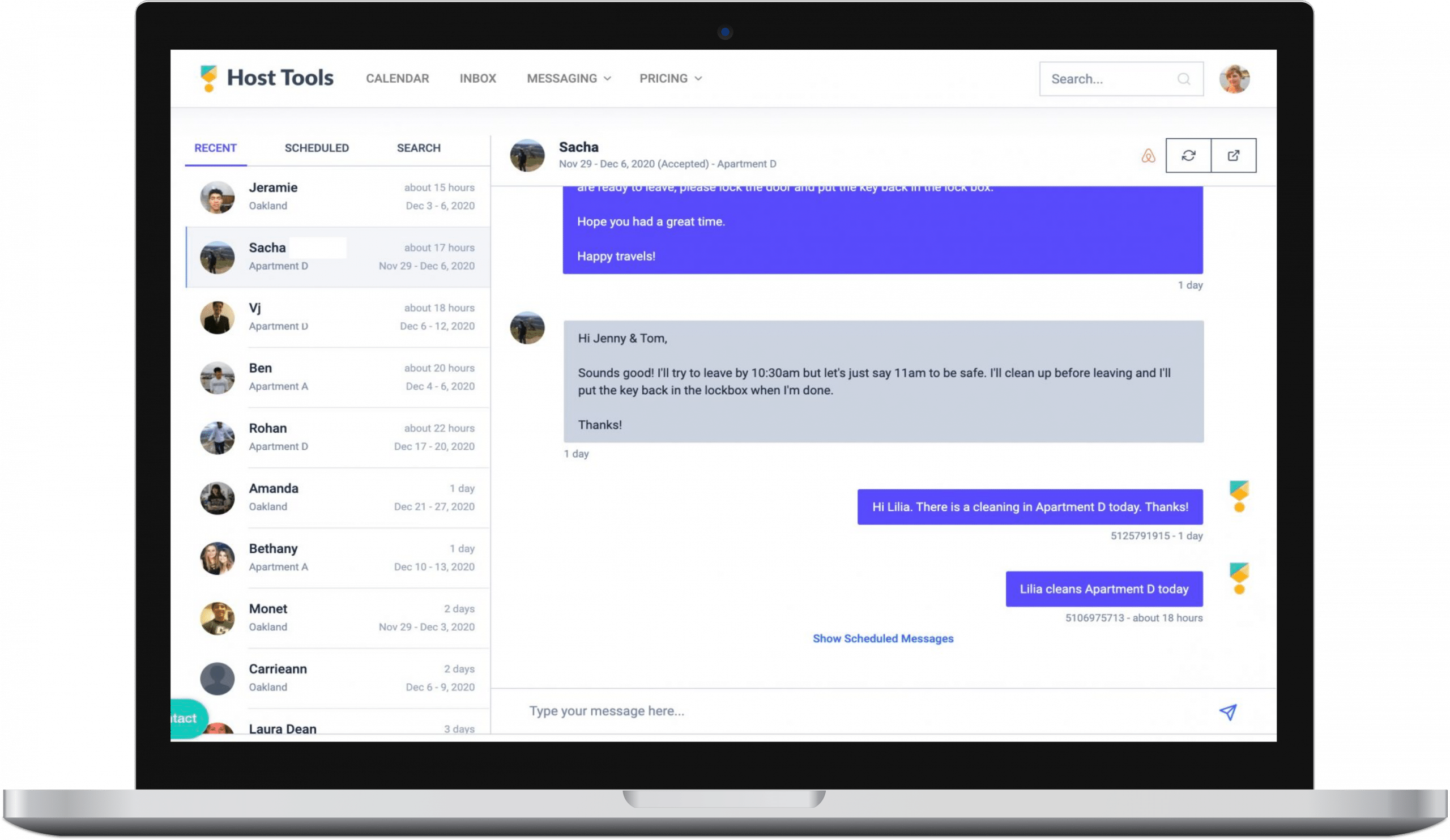

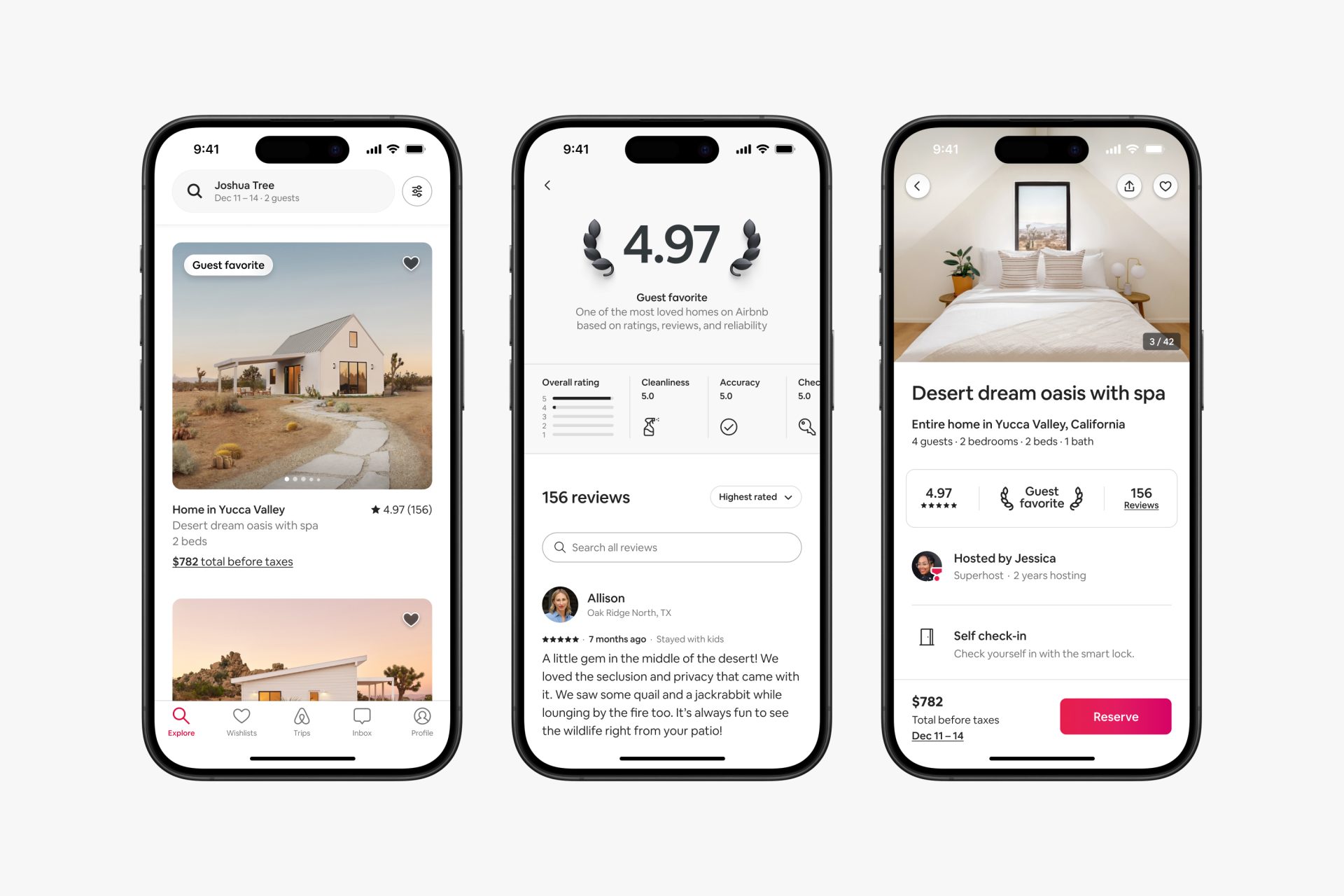

Host Tools provides an automated, unified calendar for short-term rental hosts, allowing you to seamlessly list on all major channels. Start your free trial today!

How to Start an Airbnb in Texas: Robust Regulations for Airbnb

Before you even think about how to stage your space or the right price to list, you need to know what you can and can’t do legally. Each state – and even further, each city – can have its own set of local rules and regulations when it comes to short-term rentals.

Understanding Texas Laws Pertaining to Vacation Rentals

The term ‘short-term rental’ is not explicitly defined in most state or city ordinances in Texas, making it crucial for a prospective host to research and understand the local definitions and restrictions. For example, some cities have passed ordinances specifically related to short-term rentals, such as requiring a permit or limiting the number of rental days per year.

Examining City-Specific Regulations

In addition to state laws, cities in Texas can also have their own regulations for short-term rentals. For instance, popular tourist destinations like Austin and San Antonio have specific rules on registration, taxes, and occupancy limits for short-term rentals.

It’s essential to research the individual city ordinances as they may differ from the state laws. Learn more about the specific Airbnb property regulations for each major Texas city here:

The Impact of Local HOA and Zoning Laws

Beyond city restrictions, homeowners’ associations (HOAs) and zoning ordinances can stipulate further constraints. It’s essential to understand your property’s zoning – residential, commercial, or mixed-use – and review your HOA regulations to avoid any conflicts. Some neighborhoods have strict local rules against any form of transient renting.

The Licensing and Permits You Need to Know About

Once you clearly understand the regulations governing short-term rentals in Texas cities, the next step is to get the necessary permits and licenses to operate legally.

The Hotel Occupancy Tax: Navigating Complexities

Hotel occupancy tax (HOT) in Texas is a significant piece of the puzzle. The burden of collecting and remitting the state hotel occupancy tax to the state falls on the short-term rental host, but registration is not always straightforward.

As an Airbnb host, you must apply for a hotel occupancy tax permit from the state comptroller’s office, which is tied to your property’s address. Currently, the hotel occupancy tax is 6% of your listing price.

City Permits for Texas Short-Term Rentals

Many Texas cities require a short-term rental permit to operate a short-term rental property legally. These short-term rental permits can come with their own set of fees and application processes.

It’s vital to check the specific requirements in your specific Texas city and understand the implications of non-compliance, which can result in hefty fines and, in some cases, the revocation of your short-term rental permits.

Short-Term Rental License

Many cities in Texas require short-term rental licenses, and the process can vary significantly. In Dallas, for example, you generally must apply to the city’s Development Services Department and go through a thorough review process before obtaining your license. It’s essential to research the requirements in your specific location carefully.

Final Thoughts: Preparing for the Long Haul

Starting an Airbnb property in Texas isn’t just about following a set of rules – it’s about providing a service that embodies the spirit of hospitality that the state is known for. By understanding the regulations and short-term rental permit requirements, planning for success, and putting your guests first, you can create a sustainable and profitable short-term rental business. Remember to stay adaptable, as the landscape of short-term rentals is always changing.

Host Tools provides an automated, unified calendar for short-term rental hosts, allowing you to seamlessly list on all major channels. Start your free trial today!