As a host, it’s crucial to understand and comply with the laws in your city. In Atlanta, these laws are specifically designed to ensure the safety and comfort of both hosts and guests. Atlanta Airbnb laws can sometimes seem intricate and overwhelming, especially if you are new to the hosting game. However, breaking them down to understand their implications can make the process smoother and more manageable.

This guide will provide a comprehensive look at these laws, helping you navigate the world of short-term rentals in Atlanta legally and effectively.

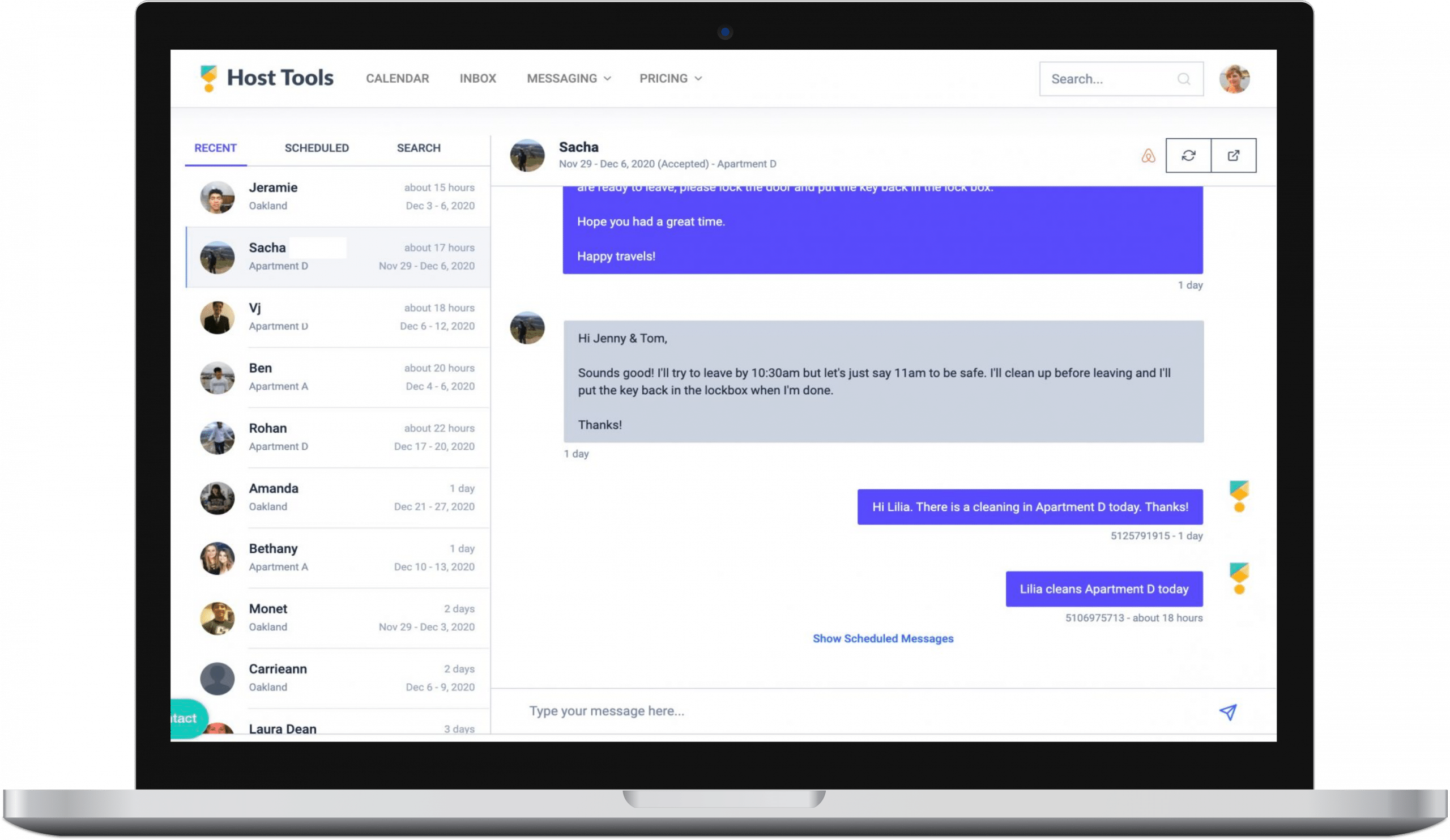

Host Tools provides an automated, unified calendar for short-term rental hosts, allowing you to seamlessly list on all major channels. Start your free trial today!

Atlanta’s Short-Term Rental Laws

In Atlanta, short-term rentals are guided by specific regulations designed to balance the needs of hosts, guests, and the wider community.

Under Atlanta law, a short-term rental unit is a residential property for less than 30 consecutive days. This includes entire homes or apartments and private or shared rooms within a home. This definition helps to distinguish short-term rentals from traditional long-term leases.

These laws and regulations are designed to create a safer and more accountable short-term rental marketplace in Atlanta. Hosts should regularly check the city’s official website for updates as they may change over time.

Zoning restrictions for short-term rentals in Atlanta

Atlanta’s zoning laws play a significant role in determining where short-term rentals can operate. Below are key zoning restrictions that hosts should be familiar with:

- Residential Areas: In most residential zones, short-term rentals are allowed but may be subject to certain restrictions, such as off-street parking requirements.

- Commercial and Mixed-Use Areas: Short-term rentals are generally permitted in commercial and mixed-use areas. However, they might be subject to other regulations, such as noise and nuisance controls.

- Historic Districts: These districts often have strict regulations on property use. Before hosting in a historic district, confirm with the city’s zoning department to avoid potential issues.

- Condominiums and Apartments: While the city may permit short-term rentals, the building’s homeowner association or property management might have its own rules prohibiting or limiting them.

Always check with Atlanta’s Department of City Planning for the most current zoning information related to short-term rentals.

Licensing requirements for short-term rentals in Atlanta

In addition to zoning restrictions, hosts contemplating short-term rentals in Atlanta should be aware of several licensing requirements:

- Business License: To operate a short-term rental unit in Atlanta, hosts are required to obtain a business license from the city. This business license must be renewed annually.

- Hotel Occupancy Tax/Hotel Motel Tax: Hosts are responsible for collecting and remitting a Hotel Occupancy Tax on behalf of their guests. The rate is currently set at 8% of the rental price (excluding cleaning and additional guest fees). This is also referred to as the “Hotel Motel Tax”.

- Sales Tax: Hosts in Georgia are also obligated to collect state sales tax for stays 89 nights and under, which is 4% in addition to the local Atlanta tax of 4%, totaling 8%.

- Insurance: While not technically a licensing requirement, it’s strongly recommended that hosts secure adequate short-term rental insurance coverage to protect against property damage or liability.

- Short-Term Rental License: If you own or rent two properties within the city of Atlanta and want to rent one or both as a short-term rental, you must register one as a primary residence. This is in addition to your business license.

Tax obligations

Understanding your tax obligations is essential for hosts operating rentals in Atlanta to ensure compliance with local and state laws. Here are the key tax-related responsibilities you should be aware of:

- Income Tax: All income generated from your short-term rental unit should be reported on your income tax return. This includes any fees charged to guests for cleaning, late check-in, or additional services.

- Property Tax: Whether you own or rent the property used for short-term rental units you may be liable for property taxes. The amount varies based on the assessed value of your property and the local tax rate.

- Hotel Occupancy Tax and Sales Tax: As stated earlier, you are responsible for collecting and remitting the Hotel Occupancy Tax and Sales Tax charged on rentals. Failure to do so may result in penalties.

- Quarterly Tax Payments: If your short-term rental is profitable, you may need to make estimated tax payments on a quarterly basis to avoid potential penalties at the year-end. Consult with a tax professional to understand your obligations.

- Record Keeping: Ensure accurate record-keeping of all your transactions, including income and expenses related to your short-term rental unit. This will be crucial when preparing your tax return or in the event of an audit.

Legal Consequences of Non-Compliance

Non-compliance with Atlanta’s short-term rental laws can lead to serious legal and financial consequences for hosts. Here are some possible ramifications to be aware of:

- Fines and Penalties: Violation of local regulations can result in hefty fines, which can significantly impact hosts’ earnings. These fines can range anywhere from a few hundred to several thousand dollars per violation.

- Legal Actions: In extreme cases, the city may take legal action against hosts who consistently fail to comply with the laws. This could include court summonses and potential litigation.

- Suspension or Revocation of Permit: Your permit to operate a short-term rental in Atlanta could be suspended or revoked if you fail to adhere to the guidelines. This means you would have to cease operations until you can demonstrate compliance.

- Back Taxes and Interest: If you fail to remit the necessary taxes on your short-term rental income, you could be liable for the unpaid taxes plus interest and, in some cases, additional penalties.

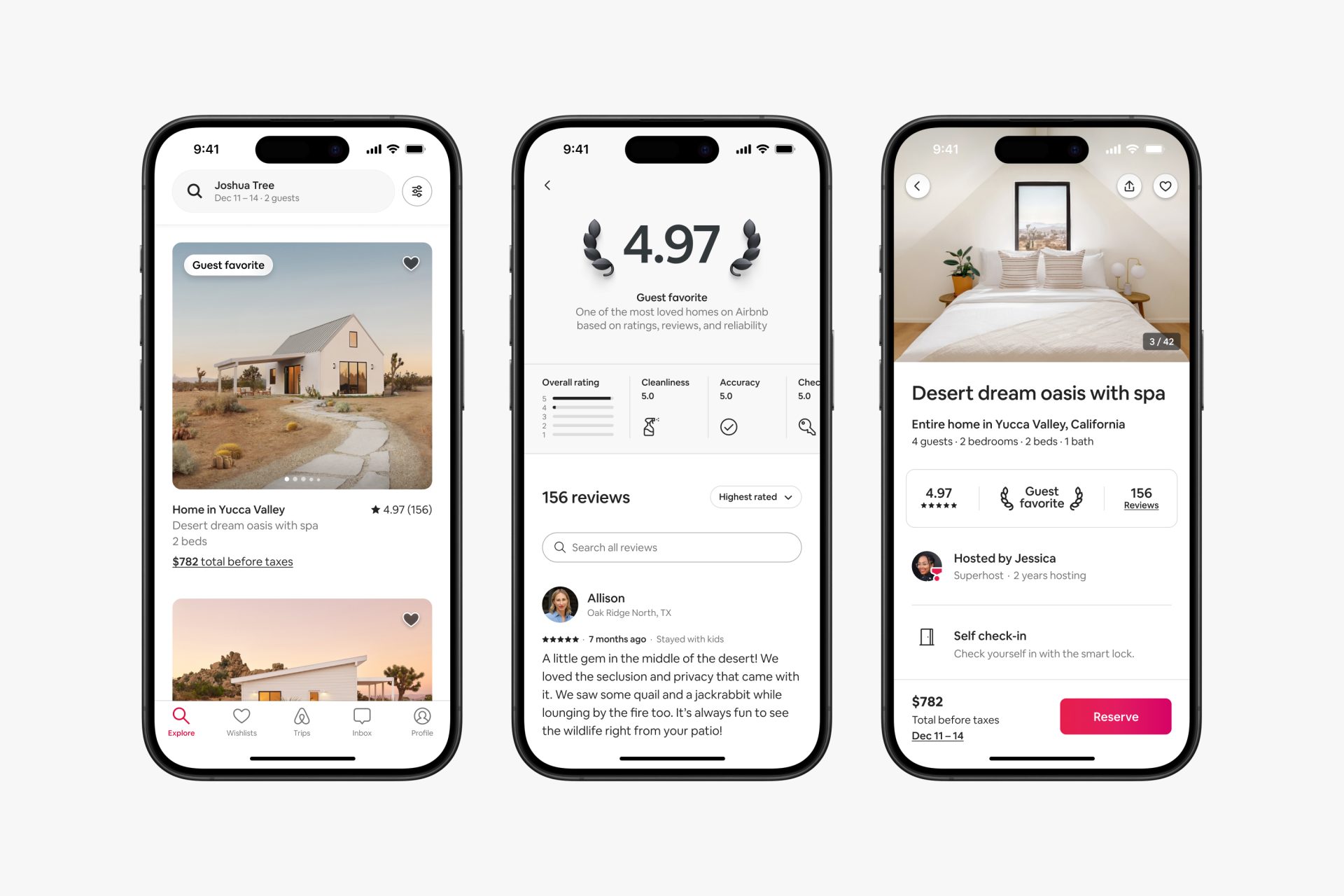

- Damage to Reputation: Failure to comply with local regulations can also damage your reputation as a host. This can lead to negative reviews, loss of Superhost status on platforms like Airbnb, and a decrease in bookings.

Understanding and adhering to Atlanta’s short-term rental laws is crucial to avoiding these potential legal and financial pitfalls.

Tips for Staying Compliant

Maintaining compliance with Atlanta’s short-term rental laws may seem daunting, but it doesn’t have to be. With a proper understanding of the regulations and a commitment to uphold them, you can operate your Airbnb property or other short-term rental with confidence.

Here are some tips to help you stay on the right side of the law and avoid any potential legal troubles.

- Understand Local Laws: Make it a point to understand and stay updated on Atlanta’s short-term rental laws. These laws can change frequently, so keep an eye on local news and government websites.

- Keep Accurate Records: Maintain a comprehensive record of all rental activity, including dates of stay, rental income, and expenses. This can be useful not only for tax purposes but also for any potential audits by city officials.

- Pay Your Taxes: Be diligent in calculating and remitting your taxes on time. Late payments can result in fines and penalties.

- Transparent Communication: If you are unsure about any regulations, don’t hesitate to reach out to city officials. They can provide clarity on any confusion you might have about the laws related to short-term rentals in Atlanta.

- Operate with a Valid Permit: Always ensure you have a valid permit for your short-term rental. Regularly check the status of your permit to avoid any violations.

- Invest in Liability Insurance: Consider getting a liability insurance policy for your short-term rental. This can provide protection in case of accidents or damages.

- Be a Good Neighbor: Respect your neighbors and their rights to peace and quiet. Make sure your guests adhere to the same rules, such as not causing excessive noise or parking inconsiderately. Invest in a noise monitor to prevent unwanted parties at any of your short-term rental properties.

By taking these steps, hosts can ensure that they are in compliance with all relevant laws and regulations, protecting their vacation rental business from potential legal and financial pitfalls.

Additional Resources

For further guidance, consider leveraging the following resources and organizations:

- City of Atlanta’s Official Website: The City of Atlanta’s website provides comprehensive information on local short-term rental laws and policies, including how to obtain a permit for your Airbnb property and details about tax requirements.

- Airbnb Responsible Hosting in Atlanta: Airbnb provides a useful guide on responsible hosting in Atlanta, with links to applicable laws and regulations.

- Atlanta Short-Term Rental Association (ASTRA): ASTRA is a local organization that offers support and resources to short-term rental hosts in Atlanta. They can provide advice and guidance on compliance issues, tax obligations, and best practices.

- Legal Advice: Consult with a local attorney or legal firm specializing in real estate or rental law. They can provide personalized advice and ensure you are fully compliant with Airbnb laws and other short-term rental regulations.

- Local Hosting Forums: Participate in local hosting forums or community groups. These platforms can be a great source of real-time information, advice, and support from fellow Atlanta Airbnb hosts who are dealing with similar issues.

Remember, staying informed and proactive can help you navigate the regulatory landscape of rentals in Atlanta successfully.

Final Thoughts

Compliance with short-term rental industry laws in Atlanta is essential for every Airbnb host to ensure a successful and legally sound operation. These short-term rental regulations and rules can seem overwhelming, but by using the resources provided and staying informed, you can navigate the landscape of Airbnb laws with confidence.

Don’t be afraid to seek help when needed, be it through local communities of other Airbnb hosts, legal counsel, or organizations like ASTRA. Plus, be sure to get all of your certifications, like the Hotel Motel Tax.

Remember, the key to successful hosting doesn’t stop at providing a great space for your guests; it also involves conscientious and lawful management.

Host Tools provides an automated, unified calendar for short-term rental hosts, allowing you to seamlessly list on all major channels. Start your free trial today!