Investing in the short-term rental market presents exciting income opportunities. However, securing the necessary capital can be a daunting challenge for many potential hosts.

Enter short-term rental loans. In this guide, we’ll demystify these unique loans, discuss their advantages, and how you can leverage them to grow your rental business.

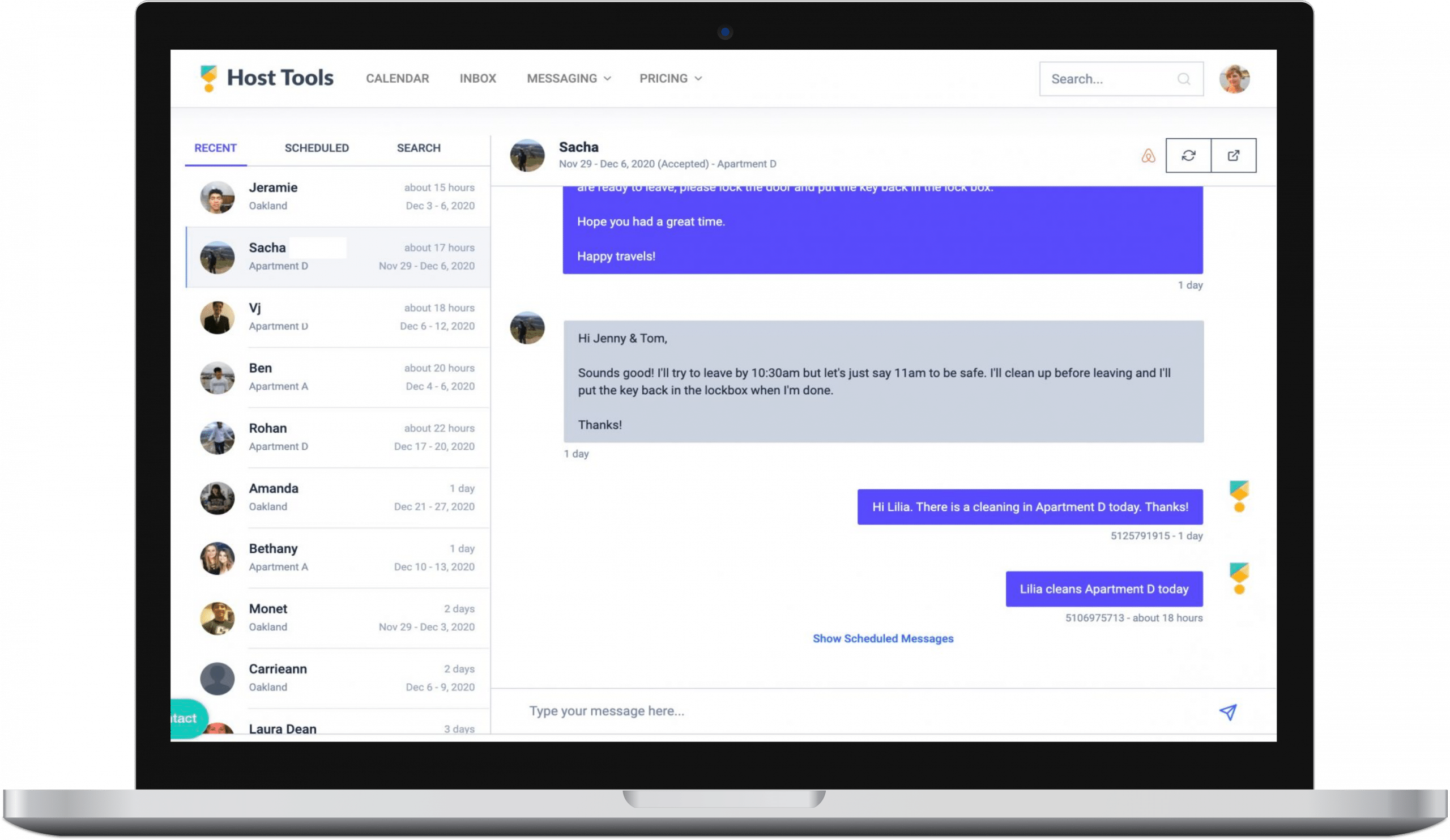

Host Tools provides an automated, unified calendar for short-term rental hosts, allowing you to seamlessly list on all major channels. Start your free trial today!

What are Short-Term Rental Loans?

Short-term rental loans, often referred to as Airbnb loans, are specifically tailored loans designed to cater to the needs of the short-term rental market. These loans are ideal for hosts looking to invest in properties designated for short-term rent on platforms such as Booking, Airbnb, or Vrbo.

Here’s a quick rundown of what they entail:

-

Purpose-Specific: These loans are primarily used for purchasing, renovating, or expanding a portfolio of short-term rental properties.

-

Flexibility: They offer more flexibility than conventional loans because funders understand the unique needs and income patterns of the short-term rental industry.

-

Loan Period: The loan term is typically short-term, ranging from a few years to a decade.

-

Interest Rates: Interest rates can be higher than conventional mortgages due to the increased risk associated with short-term rental properties.

-

DSCR Loans: A subtype of short-term rental loans is a Debt-Service Coverage Ratio (DSCR) loan, which evaluates a property’s ability to generate enough income to cover the loan payments.

As you can see, short-term rental loans provide a viable route for those seeking to venture into or expand within the short-term rental market. However, due diligence is strongly advised before committing to any loan.

Types of Short-Term Rental Loans

Understanding the different Airbnb loan options will empower you to make an informed decision that aligns with your investment strategy and financial goals:

Bank loans

Best for: Lower interest rates / Buying a single property

Cons: Less flexibility with unpredictable income, higher credit score required

Bank loans can be a viable option for short-term rental hosts, especially if you’re looking to invest in a single property and your personal income is high enough to support an extra mortgage. Traditional banks typically offer lower interest rates than specialized short-term rental loans, making the cost of borrowing more affordable.

However, securing a bank loan can be more challenging for hosts due to strict lending criteria. Banks often require solid proof of income, a good credit score, and a substantial down payment.

They may also be less understanding of the unique income patterns of the short-term rental market, which can fluctuate based on factors such as seasonality or economic conditions. Despite these obstacles, bank loans can be a great financing option under the right circumstances, providing access to larger loan amounts and longer repayment terms.

As always, thorough research and consideration of your unique financial situation are essential before pursuing this avenue.

Hard money loans

Best for: Quick approval / Purchasing unconventional properties

Cons: Shorter repayment period

Hard money loans can be an effective solution for short-term rental hosts looking to invest in unconventional properties or needing swift approval. This type of loan is provided by private lenders, with the approval process often being more rapid than other financing options. In addition, a borrower’s credit score isn’t as influential in securing a hard money loan, making it a viable choice for those with less-than-stellar credit histories.

However, it’s important to note that hard money loans typically come with higher interest rates and down payments than other lending options. The repayment period is also shorter, generally ranging from one to three years.

Hard money loans do come with their share of risks, though. Due to their higher costs and short repayment terms, they should ideally be considered by those with a sound understanding of the short-term rental market, a clear business strategy, and the ability to repay the loan within the stipulated period.

DSCR loans

Best for: Leveraging rental income for loan qualification

Cons: Dependent on strong rental income

DSCR loans, short for Debt-service Coverage Ratio loans, are an increasingly popular option for short-term rental hosts, particularly those operating on platforms like Airbnb and Vrbo. What sets these loans apart is that they use the monthly rental income potential of the property to evaluate your ability to repay the loan rather than relying solely on personal income or credit score.

This factor makes DSCR loans ideal for short-term rental real estate investment, as it acknowledges the unique revenue streams these properties generate. It’s a method of financing that is more in tune with the dynamic cash flow of a short-term rental business model, where a property’s monthly rental income can be quite robust.

However, it’s worth noting that the success of a DSCR loan rests heavily on the strength of the rental income. If the property’s rental income falls short, it could affect the Debt Service Coverage Ratio and the feasibility of the loan.

Therefore, it’s essential to have a solid understanding of the short-term rental market and potential income before pursuing a DSCR loan.

When to Consider Short-Term Rental Loans?

Short-term rental loans can significantly aid in growing your short-term rental business. When might you consider applying for such a loan? Here are three common scenarios:

-

Buying a New Vacation Rental Property: If you’ve spotted a lucrative property that would make a fantastic addition to your short-term rentals, a short-term rental loan could provide the necessary capital. Using the anticipated rental income of the property for loan qualification, you could secure the funding required to make the purchase.

-

Renovating an Existing Property: Perhaps you already own a property that could generate substantial short-term rental income with a few upgrades or renovations. A short-term rental loan can help finance these improvements, ultimately increasing the property’s rental income potential.

-

Growing Your Collection of Properties: If you’re looking to expand your portfolio of short-term rental properties, a short-term rental loan could help expedite this process. By leveraging the combined rental income of your existing properties and any new acquisitions, you may qualify for larger loan amounts, allowing for substantial growth in your business.

Choosing the Right Lender for Your Short-Term Rental Loan

Choosing the right lender for your short-term rental loan is a critical decision. It is important to consider a few key factors when making your choice:

-

Experience in the Short-Term Rental Market: Find a lender that understands the unique dynamics of the short-term rental market. They should be familiar with platforms like Airbnb and understand the market’s fluctuating rental incomes.

-

Competitive Interest Rates: As with any loan, the interest rate will significantly affect your total repayment amount. Seek lenders who offer competitive rates to maximize your potential return on investment.

-

Flexible Terms: Look for a lender who offers terms that align with your business goals. Whether you need a shorter loan term for a quick renovation project or a longer term for buying a new property, the lender should be able to accommodate your needs.

-

Customer Service: Good customer service is crucial. The lender should be responsive, transparent about fees and conditions, and willing to work with you to find the best loan solution.

As for recommendations, the following lenders are known for their extensive experience in the short-term rental market. They offer competitive rates, flexible terms, and excellent customer service, making them a great starting point for your research:

Note: it’s always best to do your own research and choose the one that best fits your specific needs.

Final Thoughts on Short-Term Rental Loans

Securing short-term rental loans can be a strategic move for savvy investors in the property market. By leveraging loans, you can tap into the income potential of the property itself rather than relying solely on personal financial credentials.

However, it’s important to select a lender familiar with the STR real estate market, offers competitive interest rates, provides flexible terms, and delivers excellent customer service. With diligent research and strategic planning, these loans can serve as a catalyst for achieving a significant return on investment in your vacation rental venture.

Host Tools provides an automated, unified calendar for short-term rental hosts, allowing you to seamlessly list on all major channels. Start your free trial today!