Airbnb has transformed the hospitality industry, and savvy hosts are always on the lookout for ways to maximize their earnings and benefits. One often overlooked aspect is the role of your credit card.

In this article, we’ll explore the best credit cards for Airbnb hosts. Here we’ll unlock the potential of your hosting business and make your credit card work harder for you.

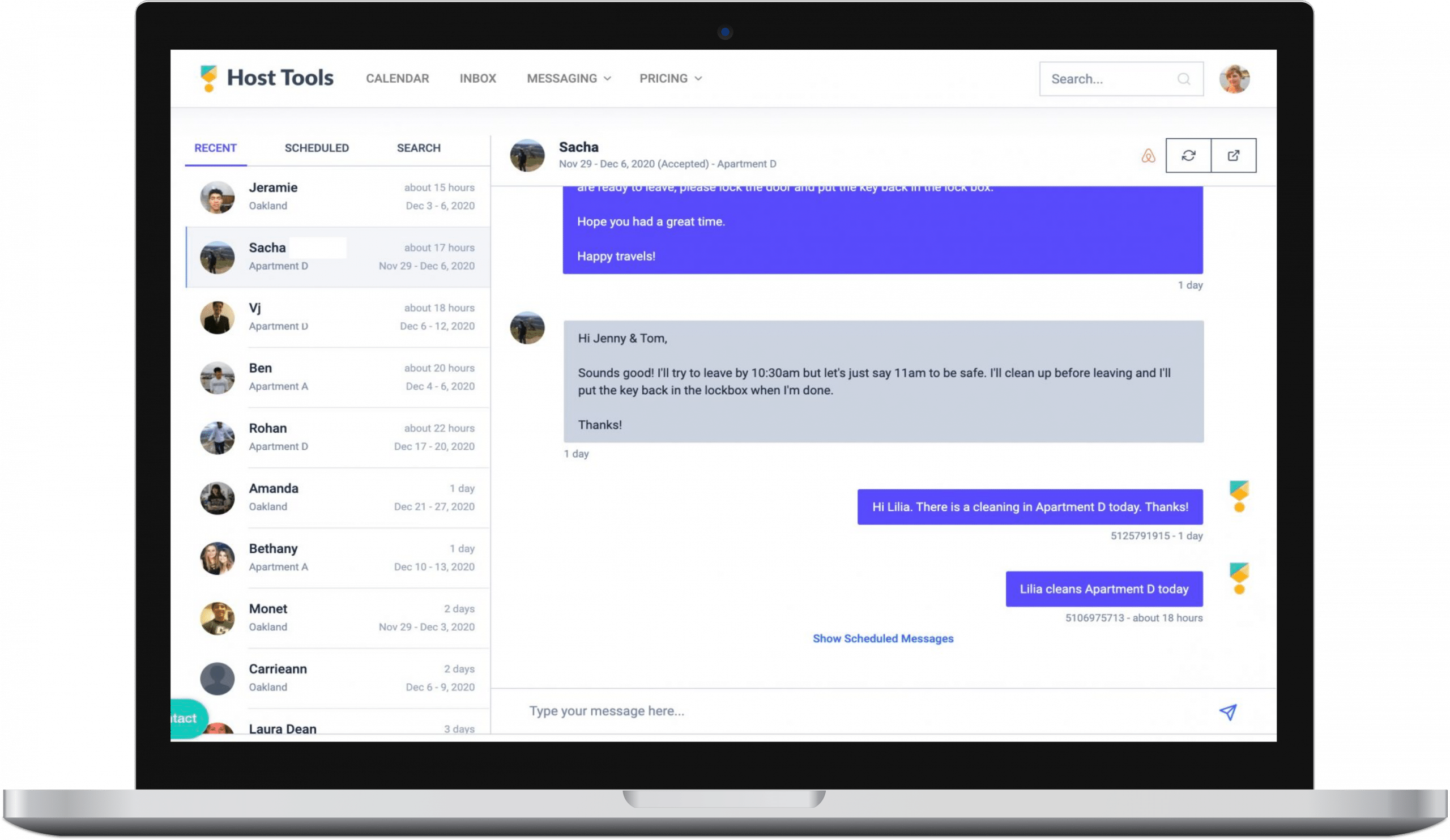

Host Tools provides an automated, unified calendar for short-term rental hosts, allowing you to seamlessly list on all major channels. Start your free trial today!

How a Credit Card Can Benefit Hosts

Choosing the best credit card for Airbnb hosts can contribute significantly to your financial success as a short-term rental host. Here’s how:

-

Reward Programs: An excellent credit card can offer rewarding programs, converting your business expenses into points that you can redeem for travel, gift cards, or even cash back.

-

Purchase Protection: Protection against damage or theft for your purchases can be a valuable feature of your credit card, ensuring safety for items you buy for your rental property.

-

Higher Credit Limits: A card with a higher credit limit can help you manage bigger expenses, like property renovations or purchasing new furniture, with ease.

-

Business Features: Cards that offer business-specific features such as itemized statements or year-end summaries can make managing your rental property business simpler and more efficient.

What to Look for in a Credit Card as a Host

As an Airbnb host, there are several important factors you should consider when selecting the best credit card for your needs:

-

Rewards and Bonuses: Look for cards that provide high reward rates on categories you spend the most on, such as utilities, maintenance, and home improvement stores. Some cards offer sizable sign-up bonuses if you meet a certain spending threshold within the first few months, which can be a substantial boost.

-

Introductory APR: Cards with a low or 0% introductory APR can be beneficial if you plan to make large purchases upfront and pay them off over time.

-

Travel Benefits: If you’re an avid traveler, consider a card offering benefits like free access to airport lounges, travel insurance, and no blackout dates on reward travel.

-

Annual Fee: Compare the card’s annual fee against its benefits. The best credit cards for Airbnb hosts often pay for themselves through the rewards and benefits they offer.

Remember, the best credit card for Airbnb hosts depends on your needs and spending patterns.

5 Best Credit Cards for Airbnb Hosts

In the following section, we detail the top five credit cards that offer significant advantages to Airbnb hosts:

Chase Sapphire Preferred

-

Rewards: Allows cardholders to earn 2x points on travel and dining purchases.

-

Travel Benefits: Points earned can be redeemed for statement credits against Airbnb purchases, a unique feature that makes it one of the best credit cards for hosts. It also offers high rewards for other travel-related expenses, like car rentals.

-

Other Advantages: The card’s Ultimate Rewards program offers 25% more value when redeemed for travel through Chase, making your stays and other travel experiences more rewarding.

-

APR: 21.49% to 28.49%

-

Annual Fee: $95.

Chase Sapphire Reserve

-

Rewards: This card stands out with 3x points on travel and dining. Additionally, it offers 1 point per dollar spent on all other purchases. Even more appealing, the card comes with a $300 annual travel credit to use towards any travel expenses.

-

Travel Benefits: For hosts who frequently travel, the card includes exciting benefits like free Global Entry application fee credit and airport lounge access.

-

APR: 22.49% to 29.49%

-

Annual Fee: $550. The higher annual fee may seem steep at first glance, but the generous rewards and benefits can easily offset this cost for active hosts and travelers.

Venture X Rewards Credit Card

-

Rewards: The Venture X card offers a lucrative rewards system, providing 2x miles on every purchase, making it ideal for hosts with a high expenditure rate.

-

Travel Benefits: This card can redeem the miles earned for travel purchases, including Airbnb stays. The Venture X card also provides access to over 1,300 airport lounges worldwide, enhancing the travel experience for hosts who also travel frequently.

-

APR: 19.99% to 29.99%

-

Annual Fee: $395.

Capital One Venture Rewards Credit Card

-

Rewards: Offers unlimited 2x miles per dollar on every purchase.

-

Travel Benefits: The miles earned can be redeemed for travel purchases, including short-term rental stays. This is particularly advantageous for hosts who also travel frequently.

-

Simplicity: This card is appreciated by many short-term rental hosts for its straightforward rewards structure and benefits.

-

APR: 0% introductory fee, 19.99%-29.99% after 15 months

-

Annual Fee: Starting at $95

Citi Double Cash Card

-

Rewards: This card stands out with its enviable cashback policy, offering 2% on all purchases– 1% when you buy and 1% as you pay.

-

Other Advantages: The card’s straightforward cashback approach is most suitable for hosts who prefer cash rewards over travel points. The consistent returns from all short-term rental-related expenses make it one of the best credit cards for Airbnb hosts.

-

Simplicity: The card is well-known for its easy-to-understand reward structure, making it a favorite among users who appreciate simplicity in their reward schemes.

-

APR: 19.24% – 29.24%

-

Annual Fee: The Citi Double Cash Card has no annual fee, making it an affordable choice for hosts looking to minimize their costs while maximizing rewards.

Maximizing Credit Card Rewards

Maximizing your credit card rewards can significantly enhance your hosting experience and profitability in the short-term rental ecosystem. By choosing the right card and using it strategically, you can earn substantial rewards, cashback, and travel points that could lead to substantial savings.

This section will guide you through various tactics to optimize your credit card usage to maximize rewards and minimize expenditure.

Tips and Strategies to Optimize Credit Card Rewards with Airbnb

Utilizing your credit card reward well as a host can greatly enhance your income. Here are some strategies to help optimize these benefits:

-

Strategic Spending: Use your reward card for all Airbnb-related expenses. This includes everything from home improvement costs to utility bills. This strategy can maximize your rewards earnings.

-

Pay in full monthly and on Time: Avoid carrying a balance and accruing interest. Pay your card balance in full every month to avoid interest charges that could offset your rewards.

-

Redeem Wisely: Understand the redemption process for your card. Some cards offer more value when you redeem for travel or specific services.

-

Leverage Bonuses: Pay attention to any sign-up bonuses or promotional offers with your card. These can greatly boost your rewards, especially in the first few months.

-

Monitor Card Performance: Regularly review your card performance. If the rewards do not offset the annual fee or your spending habits change, it might be time to consider switching to a different card.

Impact on Airbnb Income

-

Additional Income: These rewards can be seen as an additional source of income. Redeeming points for cash back or statement credits can directly offset costs.

-

Cost Saving: Rewards can be used towards business expenses such as home repairs or improvements, saving you money in the long run.

-

Improved Guest Experience: Rewards points can be used to enhance the guest experience, leading to better reviews and more bookings. For example, you could use points to upgrade the amenities or furnishings in your property.

Final Thoughts

Selecting the best credit card for Airbnb hosts can significantly enhance overall earnings and provide valuable benefits. You can maximize your rewards by strategically using your card for short-term rental-related costs, paying your balance in full and on time, redeeming wisely, leveraging bonuses, and regularly reviewing your card’s performance.

The additional income, cost-saving potential, and opportunities to improve guest experiences all contribute to the appeal of these cards. However, choosing a card that aligns best with your spending habits and financial goals is crucial. Consider your options carefully and make an informed decision that benefits your business the most.

Host Tools provides an automated, unified calendar for short-term rental hosts, allowing you to seamlessly list on all major channels. Start your free trial today!