Security deposits often serve as a safety net, protecting hosts against potential damages. Airbnb security deposits haves become an essential component of the rental process.

This article will delve into the intricacies of security deposits and explore various insurance options available to hosts. We aim to provide a comprehensive understanding of how these mechanisms work to safeguard both hosts and guests, enhancing trust and ensuring a smooth rental experience.

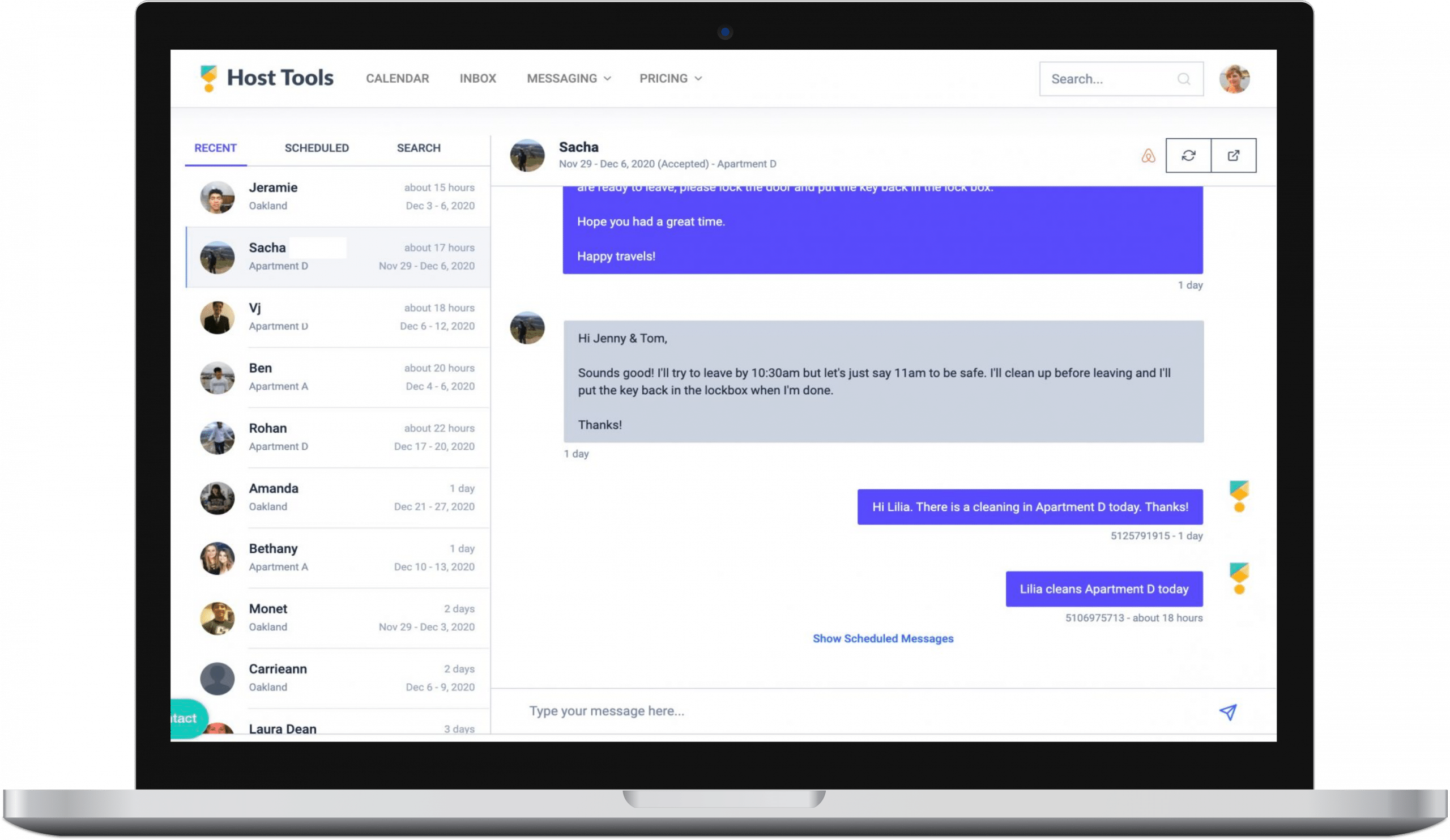

Host Tools provides an automated, unified calendar for short-term rental hosts, allowing you to seamlessly list on all major channels. Start your free trial today!

The Inevitability of Property Damage in Vacation Rentals

Operating a vacation rental comes with its unique set of challenges, among which property damage is a common occurrence. Typical examples of guest-caused damages include broken furniture, stained linens, and accidental damage to valuable décor items. More severe instances might involve structural damages, such as broken windows or damaged appliances from unauthorized parties.

The financial impact of these damages can be significant, especially for small-scale property managers. This underscores the need for robust protection measures.

Implementing a security measure like Airbnb’s security deposit or a suitable insurance plan can shield property managers from unexpected expenses, thus ensuring the sustainability of the business in the long run. These mechanisms protect your properties and offer peace of mind, allowing you to focus on providing the best experience for your guests.

Understanding Airbnb Security Deposits

Now that we’ve established the necessity for protection measures in maintaining the financial stability of your vacation rental business let’s delve deeper into the mechanics of one such mechanism –the security deposit.

Simply put, a security deposit is a sum of money paid upfront by guests to cover any potential damages that might occur during their stay. This deposit is typically collected when booking and is fully refundable, provided the property is returned in the same condition as received.

On the positive side, they offer financial protection to hosts and can act as a deterrent to irresponsible behavior by guests. However, high-security deposits can deter potential guests from booking, especially those with a tight travel budget.

Moreover, the process of claiming the deposit in case of damages can be laborious and time-consuming, and in many cases, the deposit might not fully cover the cost of substantial damages.

See Related: How to Take Refundable Security Deposits

Defining Short-Term Rental Insurance

Short-term rental insurance serves as another layer of protection for property managers, offering more comprehensive coverage than a security deposit. Insurance plans are designed to cover a wide range of potential damages and incidents that may not be covered by a security deposit, providing a more substantial safety net for hosts.

For instance, if a guest causes significant damage to your property that exceeds the value of the security deposit, having insurance can save you from incurring any out-of-pocket expenses. Moreover, insurance plans cover liabilities such as accidents or injuries that occur on your property, which are not typically included in a security deposit.

Insurance options for vacation rentals vary, and it’s crucial to find a policy that suits your specific property and business needs. Factors to consider when selecting an insurance plan include coverage limits, deductibles, and additional coverages like theft or pet damage.

Airbnb Security Deposits vs. Insurance: A Comparison

When comparing the protection coverage offered by the Airbnb security deposit and short-term rental insurance, the latter provides a broader safety net. While security deposits can cover minor damages or wear and tear, they may fall short in case of extensive damage. Insurance, on the other hand, can cover significant damages, theft, or even liability incidents such as guest injuries – events that security deposits typically don’t cover.

From a property manager‘s perspective, collecting and managing security deposits can be cumbersome. Dealing with claims, arbitrating disputes, and initiating reimbursements can take up valuable time and resources.

Conversely, although selecting the right insurance plan requires initial effort, it simplifies the process significantly. In case of damage, property managers simply need to file a claim with their insurance provider, who takes care of the subsequent procedures, saving the property managers from potential disputes and administrative hassles.

Our Recommendations

Given our extensive experience with a wide array of properties and bookings, we recommend a combined approach for optimal protection of your vacation rental business. Here’s why:

While Airbnb security deposits serve as a good deterrent for minor damages and provides a reasonable safety net for hosts, it may not cover larger-scale damages. Additionally, the administrative work involved in claiming and reimbursing these deposits can become quite tedious.

On the other hand, a comprehensive short-term rental insurance policy offers broader coverage, capturing instances that the security deposit may not cover, such as theft and guest injury liabilities. Although finding the right insurance policy requires an initial investment of time, the long-term benefits in terms of protection and time saved in administrative procedures are significant.

Therefore, our recommendation is to focus on a robot short-term rental insurance policy. That being said, a moderate Airbnb security deposit can serve as an additional safety measure to deter guests from causing any damage.

Final Thoughts

In the dynamic and ever-evolving landscape of vacation rentals, ensuring the security and sustainability of your property is paramount. While the Airbnb security deposit provides a basic level of protection, it is often insufficient in covering significant damages or incidents.

On the other hand, short-term rental insurance offers comprehensive coverage and reduces the administrative burden on property managers. As such, a combination of both—a robust insurance plan supplemented with a moderate Airbnb security deposit—ensures optimal protection.

It covers a wider range of potential damages and fosters a sense of responsibility among guests. Ultimately, the choice between these protection mechanisms depends on your specific business needs and risk tolerance. However, being prepared with the right protective measures will undoubtedly contribute to the long-term success of your vacation rental business.

Host Tools provides an automated, unified calendar for short-term rental hosts, allowing you to seamlessly list on all major channels. Start your free trial today!