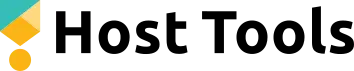

Platforms like Airbnb have revolutionized the way we view short-term rentals and travel accommodations. However, as a host, it’s essential to understand the implications of self-employment tax on your income. This guide aims to elucidate the concept of the “Airbnb self-employment tax,” outlining the tax codes and regulations you need to be aware of and providing useful tips to ensure you’re meeting your tax obligations while maximizing your income as a host.

Host Tools provides an automated, unified calendar for short-term rental hosts, allowing you to seamlessly list on all major channels. Start your free trial today!

Understanding Airbnb Self-Employment Taxes

Airbnb self-employment taxes are essentially the self-employed version of the Social Security and Medicare taxes that employees pay. As a short-term rental host, you are running a business, and hence, you are considered self-employed. This means you are responsible for paying these taxes. At the time of publishing, the federal self-employment tax rate is 15.3%, with 12.4% going to Social Security and 2.9% allocated to Medicare. Your state income tax will obviously vary.

It is crucial to understand that while employers usually cover half of these taxes for their employees, self-employed individuals are responsible for the entire amount. However, it’s not all bad news! Self-employed individuals, including hosts, get to deduct business expenses, which can significantly lower taxable income. This includes expenses incurred for the maintenance of the rental space, like cleaning costs, repairs, and even some utility bills. Ensuring you keep accurate and detailed records of these expenses helps minimize your self-employment tax liability.

Federal Airbnb Self-Employment Tax

Short-term rental income is typically subject to federal self-employment tax because it is considered business income. However, certain conditions may exempt you from these taxes. If you only rent out your property for 14 days or less over the course of the year, for instance, you are not required to report this income on your federal tax return. This ‘Masters Rule,’ named for homeowners renting out their homes during the Masters Golf Tournament, can be quite beneficial. Conversely, if you rent out your property for more than 14 days in a year, you will need to report this income.

Do keep in mind that these rules may vary based on your specific situation, and it’s always best to consult with a tax professional. Filing taxes as a self-employed individual might be more complicated than as an employee, but understanding how the system works will ensure you are compliant with tax laws and help you maximize your after-tax profits.

State and Local Taxes for Airbnb Hosts

In addition to federal self-employment tax, you may also be required to pay state and local taxes. These taxes vary depending on the location of your rental property. Some states and municipalities require hosts to collect occupancy tax from guests and pass it on to the local government.

Often referred to as the ‘hotel tax’ or ‘transient occupancy tax,’ the rate can vary widely from one location to another. As a host, you need to be aware of these tax requirements and incorporate them into your pricing structure or collect them separately from your guests. The Airbnb platform has made agreements with some jurisdictions to collect and remit certain local taxes on behalf of hosts, so it’s a good idea to check if this applies to your location. You can find this information on Airbnb’s website.

Diligently understanding and following your state and local tax obligations can keep you compliant while avoiding potential penalties or back taxes. However, because tax laws can be complex and change frequently, it’s highly recommended that short-term rental hosts consult with a tax professional or advisor to ensure all tax obligations are met.

Deductibles and Tax Credits for Airbnb Hosts

Just as there are tax obligations for hosts, there are also potential tax benefits in the form of deductions and credits. As a small business owner, there are several expenses directly related to your rental activity that you can deduct from your taxable income.

For instance, you can typically deduct the cost of advertising your rental, any fees or commissions paid to the platform (i.e., Airbnb, Vrbo, Booking.com, etc.), the cost of cleaning and maintaining your rental property, insurance premiums, and even the cost of utilities like internet service.

Further, you might also be eligible for certain tax credits. Tax credits are even more valuable than tax deductions because they directly reduce the tax you owe rather than just reducing your taxable income. For example, if you make certain energy-efficient improvements to your rental property, you may qualify for a residential energy credit. Remember, it’s essential to keep meticulous records of all your expenses and income. This is not only a good business practice, but it also prepares you for any potential audits and ensures you’re ready to claim all the deductions and credits you’re entitled to.

Keeping Accurate Records for Tax Purposes

Maintaining accurate and detailed records is crucial for Airbnb hosts, not only to meet tax obligations but also to maximize available deductions and credits. Use a reliable method to track all income received and expenses incurred. This includes receipts for purchases made for the rental property, utility bills, insurance premiums, and any other relevant expenses.

Income records should be just as comprehensive. Keep a record of all rental transactions, including the dates, rental rates, extra charges, and the total amount paid by each guest. Keeping copies of any communication with your guests relating to financial transactions is also advisable.

Implementing a system for monitoring and recording these details can initially seem daunting, but numerous software options can simplify this process—these range from simple spreadsheet programs to more sophisticated rental property management software. One important aspect to remember is the need to keep these records for a minimum of three years from your tax filing date, as stipulated by the IRS. However, keeping them longer may be beneficial if any questions arise in the future about a past return.

While this record-keeping might seem cumbersome, it is an integral part of managing your short-term rental business. Accurate records not only help to ensure you’re paying the right amount in taxes, but they can also provide valuable insights into your business operations, helping you to identify areas of potential savings or revenue growth. Remember, when in doubt, seek advice from a tax professional to ensure you’re meeting all your tax obligations and taking advantage of all applicable tax benefits.

Final Thoughts

Being a host can be a lucrative venture, but it also comes with its share of responsibilities, particularly regarding taxes. Understanding your obligations for self-employment, state, and local taxes, as well as the potential deductions and credits you can claim, is crucial to running a successful and compliant business. Implementing robust record-keeping practices facilitates accurate tax reporting and helps identify areas for business improvement. While navigating tax laws might seem intimidating, seeking professional advice can ease the process. Remember, while taxes are a part of doing business, being well-informed and proactive can help you maximize your profits while staying in line with the law.

Host Tools provides an automated, unified calendar for short-term rental hosts, allowing you to seamlessly list on all major channels. Start your free trial today!